Advertisement|Remove ads.

DMart Operator Avenue Supermarts At Crossroads Ahead Of Earnings: SEBI RA Eyes Bullish Trigger If Q1 Delivers

Avenue Supermarts, which operates the supermarket chain DMart, is trading in a broad consolidation zone as investors await its Q1 results, scheduled for July 11. The stock has fallen 29% from its all-time high.

On the technical front, Avenue Supermarts is trading between the support zone of ₹3,250 and a supply zone near ₹4,600, SEBI-registered analyst Rohit Mehta observed.

The chart shows multiple rejections near the upper band of the range, suggesting persistent resistance pressure. However, a series of higher lows since early 2024 indicates a slight bullish bias.

A breakout above ₹4,500 - ₹4,600, if sustained with volume, could potentially trigger the next leg of the uptrend, he said.

Q1 Preview

Investors will be closely monitoring the company’s revenue growth, operating margins, and commentary on store additions and trends in rural demand. Insights on inflation and consumer behavior will also be crucial, Mehta added.

In terms of shareholding, promoter holding has remained stable at 74.64%. Foreign institutional investors (FIIs) reduced their stake from 8.96% to 8.18%, while domestic shareholding increased to 9.08% from 8.07%.

The company is virtually debt-free and has achieved a median sales growth of 26.4% over the past decade. However, the stock trades at a rich valuation of 12.7 times its book value and has yet to declare any dividends, despite consistent profitability.

Mehta concluded that DMart was at a crucial juncture. If Q1 surprises on the upside, a move toward ₹4,500 and higher could be on the cards. If not, he advises watching the ₹3,800–₹3,600 support zone closely.

Avenue Supermarts’ stock was marginally lower at ₹4,172.60 on Thursday. It has gained 17.2% year-to-date (YTD).

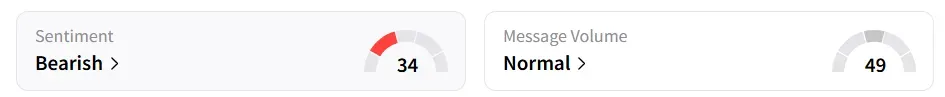

Retail sentiment turned ‘bearish’ from ‘neutral’ a day earlier.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es6_jpg_b768981c5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228901180_jpg_0c2cc7dc28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)