Advertisement|Remove ads.

Dabur Shares: Fresh Breakout After Long Consolidation, SEBI RA Sees Bullish Swing Toward ₹545

Dabur surged over 3% on Monday after releasing its first-quarter (Q1 FY26) operational update. The company expects a sequential rebound to be led by urban volumes.

While they forecast operating profit growth to lag revenue growth marginally in the June quarter, their home care and personal care divisions are expected to perform well. Additionally, they see their international business is on track for a double-digit growth on a constant currency basis, as the focus on premium portfolio continues.

The stock has broken above a crucial resistance zone of ₹500–₹508. This move is accompanied by strong volume and signals a renewed bullish sentiment in Dabur stock that had been consolidating for months, according to SEBI-registered analyst Financial Independence.

Its technical chart displays a bullish breakout with rising volume and a clear higher-low structure. Dabur’s Relative Strength Index (RSI) is at 71.7, indicating strong momentum, but also near overbought levels. They added that short-term caution or partial profit booking may be considered.

A sustained move above ₹515 could take the stock toward ₹530–₹545 in the near term. Meanwhile, its support on dips now shifts to the ₹490–₹495 zone. Financial Independence also observed that its volume spike adds credibility to the breakout, suggesting accumulation at lower levels before this move.

They advised traders to maintain disciplined risk management. An entry on dips near ₹495–₹500 with a stop loss below ₹480 could offer a favorable risk-reward swing setup.

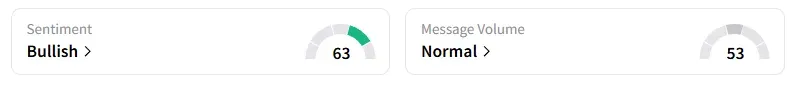

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

Dabur shares are flattish year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)