Advertisement|Remove ads.

Darden Flags Q2 Profit Slowdown Amid Surging Beef Costs, CFO Says Price Spike Is Unsustainable

Darden Restaurants’ (DRI) Chief Financial Officer, Raj Vennam, stated that the company has reaffirmed its full-year earnings per share (EPS) forecast and anticipates the lowest year-over-year EPS growth to occur in the second quarter, driven by a significant increase in beef costs and a measured approach to pricing these costs.

“There's been a significant spike in beef costs recently, especially tenders and rib eyes. We don't believe these price levels are sustainable,” Vennam said on a post-earnings call.

He added that due to the significant price increase, the company was starting to see “some demand destruction in retail.” “I guess really the big picture, beef is the biggest variable here. The other component here where you're seeing a higher inflation is on seafood, primarily due to the tariffs on shrimp,” stated Vennam.

Darden maintained its fiscal 2026 adjusted EPS forecast to be between $10.50 and $10.70. The company now expects annual sales growth to be between 7.5% and 8.5%, compared with the previous forecast of 7% to 8% increase.

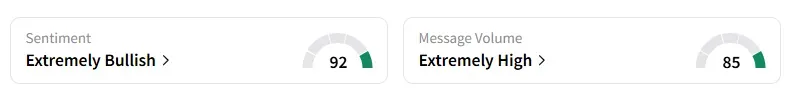

Retail sentiment on Darden remained unchanged in the ‘extremely bullish’ territory, with message volumes at ‘extremely high’ levels, according to data from Stocktwits. Shares of the company were down 10% in early trading.

The company reported that total sales at Olive Garden increased by 7.6%, driven by strong same-restaurant sales and traffic growth. LongHorn traffic was up about 3.2% for the quarter, and same restaurant sales for the segment rose 5.5%, Darden said.

Darden’s first-quarter sales came in at $3.04 billion, in line with analysts’ expectations. Its adjusted EPS was $1.97, compared with estimates of $2.01.

Shares of Darden have gained nearly 2% this year and increased by 10% over the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: FTC Sues Ticketmaster, Live Nation Over ‘Illegal’ Ticket Resale Tactics: Report

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)