Advertisement|Remove ads.

Datadog Stock Retreats Premarket As Subpar Guidance Takes Sheen Off Strong Q4: Retail Keeps The Faith

Datadog, Inc. (DDOG) shares retreated sharply in Thursday’s premarket session after the company issued disappointing guidance despite delivering a fiscal year 2024 fourth-quarter beat.

The New York-based cloud applications monitoring and security platform provider reported fourth-quarter adjusted earnings per share (EPS) of $0.49, exceeding the $0.44 year-ago figure and the $0.43 consensus estimate. The bottom-line result also beat the guidance range of $0.42-$0.44.

Revenue climbed 25% year over year (YoY) to $738 million versus the $714.53-million consensus and the $709 million to $713 million guidance range. The topline growth decelerated slightly from the 26% growth in the third quarter.

CEO Olivier Pomel said, “We are pleased with our strong execution in fiscal year 2024, with 26% year-over-year revenue growth, $871 million in operating cash flow, and $775 million in free cash flow.”

He noted that the company delivered hundreds of new features and capabilities to help customers as they migrated to the cloud and adopted new technologies like next-gen artificial intelligence (AI).

Delving into user metrics, Datadog said it had 462 customers with annual recurring revenue (ARR) of over $1 million as of Dec. 31, up 17% YoY.

The number of customers with an ARR of over $100,000 increased by 13% to 3,610.

Both metrics saw accelerated growth relative to the third quarter.

Datadog expects adjusted EPS of $0.41-$0.43 for the first quarter, trailing the $0.45 consensus estimate. It guided revenue in the range of $737 million to $741 million, surrounding the $739.9 million consensus estimate.

The company expects full-year adjusted EPS of $1.65 to $1.70 and revenue of $3.175 billion to $3.195 billion. The guidance was below the consensus estimates of $1.98 and $3.24 billion, respectively.

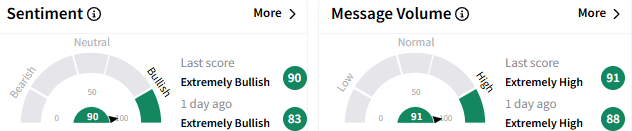

On Stocktwits, retail sentiment toward Datadog remained ‘extremely bullish’ (89/100), with the buoyant mood accompanied by ‘extremely high’ volume. The stock is among the top ten trending tickers on the platform;

A retail watcher blamed the management’s conservative stance for the disappointing guidance.

Another user called the post-earnings dip as an “overreaction.”

In premarket trading, Datadog stock fell 7.52% to $136.96. The stock has gained 3.6% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)