Advertisement|Remove ads.

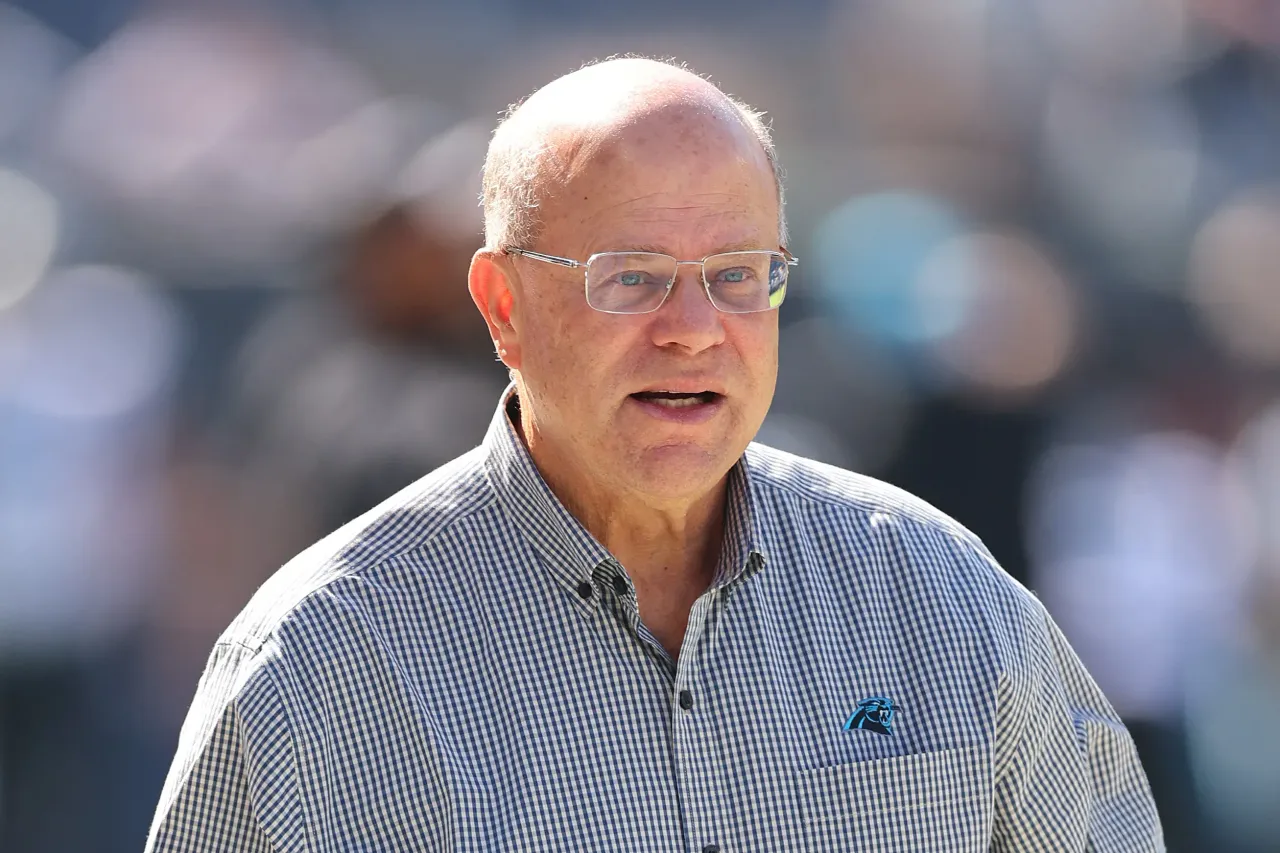

David Tepper Says Fed Can Cut Rates A Bit More, But Warns Against Easing Too Much: Report

Billionaire hedge fund manager David Tepper said on Thursday that the Federal Reserve can cut interest rates a bit further, but warned against easing too much.

In an interview with CNBC, Tepper expressed concerns that if the central bank cuts interest rates too much before inflation is brought under control, demand could outstrip supply and push prices up again.

“If they go too much more on interest rates, depending what happens with the economy ... it gets into the danger territory,” Tepper said in the interview.

Tepper added that easing the monetary policy too much could also result in the creation of asset bubbles, as people chase riskier investments to take advantage of the lower rates. “My view has been that one easing or two easings or even three easings don’t matter because we’re still in a little restrictive territory with a little bit too high inflation, even without the tariff-induced inflation. So they should be a little bit restrictive,” Tepper said.

He added that beyond this, there is a risk of inflation rising and the U.S. dollar weakening.

Announcing the rate cut on Wednesday, the Federal Open Market Committee (FOMC) highlighted the moderation in economic activity. It also touched upon the weakness in the labor market, stating that “job gains have slowed” while noting that inflation remains “elevated.”

“Uncertainty about the economic outlook remains elevated. The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen,” the FOMC said.

According to the dot plot projections, one of the votes was in favor of a 125 bps cut this year. Overall, nine of the 19 participants favored one additional cut, while 10 voted in favor of two cuts.

Meanwhile, U.S. equities surged in Thursday’s opening trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.4%, while the Invesco QQQ Trust (QQQ) surged 0.81%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘extremely bullish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was down by 0.36% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_1ebecab605.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_ATM_5257ead046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_qatarenergy_jpg_907aa26daf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243817419_jpg_fd782b2997.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191224409_jpg_fd3e69e2d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)