Advertisement. Remove ads.

Deckers Gets Slew Of Price-Target Hikes After Hoka, UGG Shoes Power Earnings Beat: Retail Sprints Into ‘Bullish’ Mood

Shares of Deckers Outdoor Corp. ($DECK) surged more than 13% pre-market on Friday following a strong Q2 earnings beat that prompted a series of price-target raises from Wall Street analysts.

The company’s fiscal Q2 revenue rose 20% year-over-year (YoY) to $1.31 billion, outpacing the $1.2 billion FactSet consensus.

This growth was largely fueled by a 35% jump in sales for Deckers’ Hoka brand, which reached $571 million, while UGG sales rose 13% to $690 million.

Net income for the quarter came in at $242 million, or $1.59 per share, surpassing analysts’ expectations of $1.24 per share.

Newly-appointed CEO Stefano Caroti, who took the helm in August, said, “HOKA and UGG produced outstanding second quarter results driven by strong consumer demand for our innovative and unique products.”

Deckers also forecasted a 12% sales increase for fiscal 2025, though it guided EPS between $5.15 and $5.25, slightly below the consensus estimate of $5.35.

Following the results, at least five Wall Street analysts raised their price targets for Deckers, with several citing strength in Hoka’s early-stage global growth and solid UGG sales.

Barclays lifted its target to $190 from $180 and reiterated an ‘Overweight’ rating, emphasizing the company’s “bullseye” positioning with Hoka’s global growth potential and Ugg’s alignment with current lifestyle footwear trends.

Evercore ISI raised its price target from $185 to $195 and maintained an ‘Outperform’ rating. The analysts described the quarter as a “solid beat across all metrics” and were impressed by the breadth of Deckers’ performance.

The brokerage highlighted the company’s cautious approach to FY25 guidance despite this quarter’s robust results, calling the outlook “very conservative,” particularly as Hoka’s momentum and Deckers’ brand portfolio seem primed to carry further upside through the year.

Deckers stock is now up over 35% year-to-date, outperforming both the S&P 500 and Nasdaq indices.

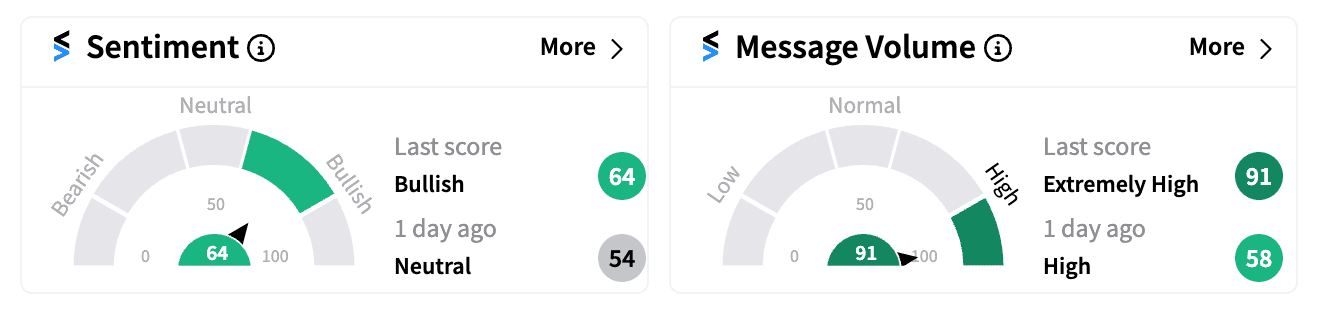

Retail sentiment on Stocktwits shifted to ‘bullish’ from ‘neutral’, with message volume jumping 1,540% on Thursday following the earnings beat.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_ny_motor_show_resized_jpg_2372b47562.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_lights_original_jpg_db38183cfe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/11/advertising.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/10/csr-corporate-social-responsibility-2024-10-528edecbe166c0116ce7a40a97faa6ff.jpg)