Advertisement|Remove ads.

Deckers Stock Tanks 12% After-Hours On Slowing Sales, Cautious Outlook — But Retail Eager To Buy The Dip

- Deckers forecasts FY26 revenue and EPS below Wall Street expectations.

- Management signals demand weakness in the near term.

- Although Q2 revenue beats expectations, the pace of growth is slowing.

Deckers Outdoor Corp.’s shares fell 12.3% in after-hours trading on Thursday after the footwear company reported slowing revenue growth and issued a cautious full-year outlook.

If the move holds in Friday’s session, it would be the stock’s worst performance in five months.

For the current fiscal year ending March 2026, Deckers expects EPS between $6.30 and $6.39, below the $6.36 analysts expected. The net sales forecast of $5.35 billion also missed the target of $5.46 billion. Deckers issued the guidance midway through the fiscal year after withholding it due to macroeconomic uncertainty.

“We’re taking into account a consumer who’s a little bit more cautious,” CFO Steven Fasching said in the post-earnings analyst call, noting U.S. consumers are pulling back on discretionary purchases as they start to see price increases.

Deckers, known for its Hoka running shoes and UGG boots, also faces competition from a resurging Nike and other legacy and new-age brands.

In the second quarter, sales rose 9% to $1.43 billion. Although higher than analysts’ expectations, it is the second time in the past two years that the growth rate has fallen below 10%. International growth also slowed to 49% from 29% in the first quarter.

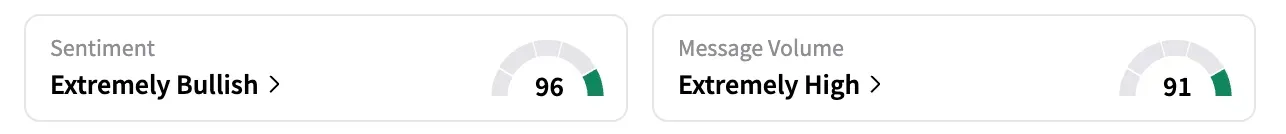

On Stocktwits, the retail sentiment for DECK climbed multiple points higher in the ‘extremely bullish’ zone, with the stock’s weakness (it’s down 50% year-to-date) among the factors making it seem attractive to retail investors.

Several users said the after-hours slide was an overreaction, especially given the top and bottom line beats. “What a gift for long term bulls. Company should come out with max buybacks over the next few months,” said a user.

A bearish user remarked that Deckers’ trajectory is similar to Lululemon, a once-innovative activewear brand that’s struggled in recent years.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Microsoft Says No To AI Erotica Bots In Clear Break With OpenAI And xAI Playbooks

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_microstrategy_michael_saylor_resized_9fd19e69ec.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)