Advertisement|Remove ads.

Dell Posts Record Q4 EPS On AI Server Boom, But Revenue Misses — Retail Cheers Dividend Hike, Valuation

Dell Technologies, Inc. (DELL) reported mixed results for the fourth quarter of the fiscal year 2025 and announced a dividend hike. The company also augmented its stock buyback authorization by $10 billion.

The fiscal year 2026 guidance was positive, but the first quarter outlook fell short of expectations.

The Round Rock, Texas-based company’s fourth-quarter non-GAAP earnings per share (EPS) climbed to a record $2.68 from $2.27 in 2024. Revenue increased 7% year over year (YoY) to $23.9 billion.

The bottom line exceeded the consensus estimates of $2.52 and the guidance of $2.50, plus or minus $0.10, while the topline trailed the $24.57 billion-consensus estimate and the guidance of $24 billion to $25 billion.

CFO Yvonne McGill said, “FY25 was a transformative year – we hit $95.6 billion in revenue, grew our core business double digits, unlocked efficiencies, and drove record EPS.”

The Infrastructure Solution Group’s (ISG) revenue rose 22% YoY to $11.4 billion, with Servers and Networking revenue climbing 37% due to artificial intelligence (AI) and traditional server demand. Storage revenue increased a much more moderate 5% to $4.7 billion.

The segment generated a record operating income of $2.1 billion, up a robust 44%.

COO Jeff Clarke said, “Our prospects for AI are strong, as we extend AI from the largest cloud service providers, into the enterprise at-scale, and out to the edge with the PC.”

“The deals we’ve booked with xAI and others puts our AI server backlog at roughly $9 billion as of today.”

The growth of the Client Solutions Group (CSG) was an anemic 1% to $11.9 billion, with the 5% growth in commercial client revenue helping to offset a 12% decline in customer revenue. The segment's operating profit fell 19% to $631 million.

Dell raised its annual dividend by 18% to $2.10, with the first quarterly distribution of $0.525 payable on May 2 to shareholders of record as of April 22. The company’s board also approved a $10 billion increase to its share repurchase authorization.

Looking ahead, the company expects an adjusted EPS of $1.65 for the first quarter and $9.30 for the full year, compared to the consensus estimates of $1.83 and $9.29, respectively.

It guided revenue for the quarter to be between $22.5 billion and $23.5 billion and for the year to be between $101 billion and $105 billion. Analysts, on average, estimate $23.72 billion and $103.62 billion, respectively.

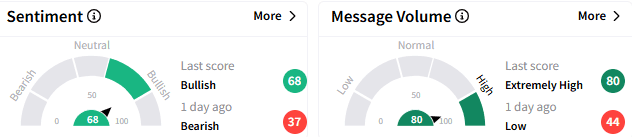

On Stocktwits, the retail sentiment toward the stock turned ‘bullish’ (68/100) from ‘bearish’ a day ago, and the message volume surged to ‘extremely high’ levels.

A retail watcher recommended buying the stock and predicted the stock would gain in Friday’s session due to the “fantastic” earnings results.

Another user sees the stock as “attractively valued,” especially when weighed against the ‘magnificent’ earnings beat and the 18% dividend increase.

Dell stock slipped 1.14% to $106.60 in the after-hours session. The stock has shed over 6% this year after a substantial 53% rally in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)