Advertisement|Remove ads.

Elastic Stock Jumps 15% After-Hours After Solid Q3 Beat, Positive Guidance: Retail Mood Stays Depressed

Elastic N.V. (ESTC) stock rallied strongly in Thursday’s after-hours session after the artificial intelligence (AI)-enabled search company announced better-than-expected fiscal results for the third quarter of the fiscal year 2025.

The San Francisco, California-based company reported third-quarter adjusted earnings per share of $0.63, sharply higher than year-ago’s $0.36 and the consensus of $0.47.

Quarterly revenue rose 17% year over year (YoY) to $382 million, exceeding the $368.91 million consensus.

Both metrics came above the guidance issued in late November by a wide margin.

Elastic Cloud revenue climbed 26% YoY to $180 million, faster than the 25% growth in the second quarter. The company’s solutions are built on the Elastic Search AI Platform, the development platform used by thousands of companies, including more than 50% of the Fortune 500 companies.

Elastic reported non-GAAP operating income and margin of $64 million and 17%, respectively. During the quarter, it generated an adjusted free cash flow of $99 million and ended the quarter with a cash position of $1.284 billion.

Among user metrics, the total customer count with an annual contract value (ACV) greater than $100,000 was over 1,460, up from 1,420 in the previous quarter and 1,270 in the year-ago quarter.

Total subscription customer count totaled 21,350 compared to 21,300 in the previous quarter and 20,800 in the year-ago quarter.

The net expansion rate was about 112%.

CEO Ash Kulkarni said the company exceeded guidance across all profitability metrics in the third quarter, helped by strong sales execution, continued market demand for its products and innovation

“Continued interest from customers building Generative AI applications and consolidating onto a single platform helped drive our outperformance during the quarter,” he added.

For the fourth quarter, the company expects adjusted EPS of $0.36-$0.37 and revenue of $379 million to $381 million, exceeding the consensus of $0.32 and $368.91, respectively.

Elastic forecasts fiscal year 2025 adjusted EPS and revenue of $1.91 to $1.96 and $1.474 billion to $1.476 billion, respectively. Analysts, on average, estimate the numbers at $1.75 and $1.460 billion, respectively.

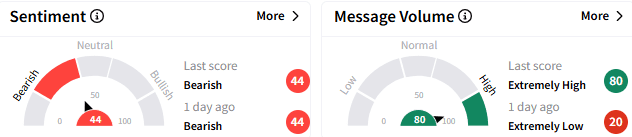

On Stockwits, sentiment toward Elastic stock remained ‘bearish’ (44/100), and the message volume improved to an ‘extremely high’ level.

Some watchers predicted a dump following the earnings-induced pump, with one qualifying the quarter as "not good."

Elastic shares surged up 15.08% in the after-hours session. The stock has gained about 2.2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Workday_logo_resized_d2d5258f05.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Lucid_jpg_221b9d07ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Draft_Kings_jpg_c77a08f48a.webp)