Advertisement|Remove ads.

Designer Brands CEO Says Traffic Picked Up In Q2, But Retail Sentiment Cools From Peak

Designer Brands (DBI) CEO Doug Howe stated on Tuesday that the declines in the second quarter represented an improvement from the first quarter, which was correlated with slightly improved consumer sentiment and a sequential increase in store traffic throughout the quarter.

“While broader macroeconomic pressures persist, these trends offer encouraging signs that some headwinds may be starting to ease,” Howe said on a post-earnings call.

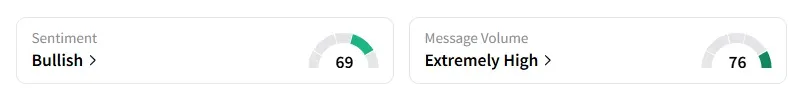

Retail sentiment on Designer Brands dipped to ‘bullish’ from ‘extremely bullish’ territory a day ago, with chatter at ‘extremely high’ levels, according to data from Stocktwits.

Shares of Designer Brands were up 5% in early trading. The company’s second-quarter net sales came in at $739.8 million, compared with Wall Street expectations of $730.6 million, according to data compiled by Fiscal AI. Its adjusted earnings per share were $0.34, compared with estimates of $0.22.

“Given the ongoing volatility with the recent tariff increases extended and the continued consumer caution around discretionary spending, we decided to continue to withhold our guidance,” Howe said.

Dana Telsey of Telsey Advisory Group said that the second-quarter results come after a largely disappointing first quarter and a challenging fiscal 2024, marked by uneven performance in products, further exacerbated by macroeconomic headwinds.

She noted that the overall footwear market remains challenged as work remains for Designer Brands to return to historical profitability levels.

Shares of the company were down 18% this year and have lost nearly a quarter of their value in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Cracker Barrel Suspends Remodels Of Its Restaurants

/filters:format(webp)https://news.stocktwits-cdn.com/large_transocean_OG_jpg_4d836b625f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Gold_bars_02f67954d1.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240656304_jpg_754321c130.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)