Advertisement|Remove ads.

Diamondback Energy In Spotlight After Lowering 2025 Output Forecast, CEO Says US Onshore Production Has Likely Peaked

Diamondback Energy (FANG) stock garnered retail attention on Monday after the oil and gas firm lowered its annual production forecast amid a decline in oil prices.

The company projected 2025 oil production between 480,000 and 495,000 barrels of oil equivalent per day, a reduction of 1% at midpoint from its prior forecast.

Diamondback also lowered its full-year 2025 capital budget to $3.4 to $3.8 billion, down from the $3.8 to $4.2 billion forecasted earlier.

The company said it is dropping three rigs and one full-time completion crew in the second quarter and expects activity to remain at similar levels through most of the third quarter.

Benchmark Brent crude oil prices fell below $60 per barrel in April for the first time since 2021 amid concerns over oversupply from OPEC+ and lower demand.

“We believe we are at a tipping point for U.S. oil production at current commodity prices,” outgoing CEO Travis Stice said.

The company projected that the number of U.S. oil-directed rigs would be down almost 10% by the end of the second quarter and decline further in the third quarter. Stice said that U.S. onshore oil production has likely peaked.

Diamondback reported adjusted net income of $4.54 per share, which topped estimates of $4.20 per share, according to FinChat data.

“We would prefer to use the incremental dollar generated to repurchase shares and pay down debt over drilling and completing wells at these prices today,” Stice said.

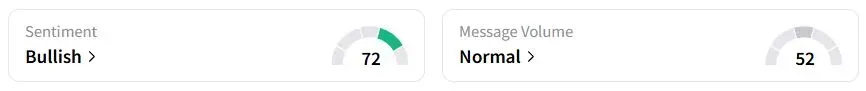

Retail sentiment on Stocktwits was in the ‘bullish’ (72/100) territory, while retail chatter was ‘normal.’

One retail trader was annoyed by a lack of movement in the stock and wondered whether to sell his holding to cut losses.

Diamondback shares have fallen 19.9% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trump_and_hegseth_1_a0df8fad8f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2150094845_jpg_eb609b5387.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247607320_jpg_f2da83c7f1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)