Advertisement|Remove ads.

Diamondback Energy CEO Steps Down Days Before Q4 Earnings: Retail Takes Notice But Remains Unfazed

Diamondback Energy (FANG) stock garnered retail attention on Thursday after it said long-term CEO Travis Stice would step down and be replaced by Chief Financial Officer Kaes Van't Hof.

The oil and gas producer said the leadership changes would be effective from the annual 2025 stockholders' meeting.

The company said that Stice would become the executive chair of the board following the transition and remain in that position till the annual stockholders’ meeting in 2026, when the oil industry veteran is expected to become the non-executive chairman.

Stice joined Diamondback as its chief operating officer in 2011 before taking charge as chief executive in Jan. 2012. Later that year, he joined the board following the company’s initial public offering.

Under Stice’s leadership, Diamondback became one of the largest shale oil producers in the U.S. through several acquisitions and efficiency gains.

Last year, it completed a $26 billion deal to buy privately held Endeavor Energy to bolster its presence in the Permian basin.

On Tuesday, the company also agreed to buy some subsidiaries of Double Eagle IV Midco in a $4.08 billion deal.

Van't Hof joined Diamondback in 2016 as the vice president of strategy and corporate development. He has been the company’s president and CFO since February 2022.

The stock was down marginally in extended trading.

The oil and gas producer is scheduled to report its fourth-quarter earnings on Feb. 24 after the bell.

Its peers Devon Energy and Occidental Petroleum have topped quarterly profit estimates, aided by higher production and an uptick in gas prices.

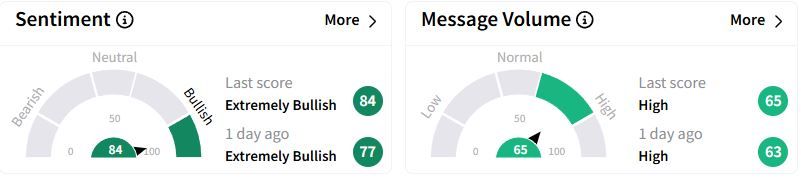

Retail sentiment on Stocktwits moved higher in the ‘extremely bullish’ (84/100) territory than a day ago, while retail chatter remained ‘high.’

One bullish retail trader called the news "huge," while another said they had bought 1,000 shares of FANG following the development.

Over the past year, Diamondback shares have fallen 8.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)