Advertisement|Remove ads.

Berkshire Hathaway In Spotlight As Cash Pile Rises To Record $334.2 B, Retail Ponders Buffett’s Next Move

Berkshire Hathaway (BRK.B) garnered retail attention over the weekend as investors wondered what the conglomerate’s next move would be after its cash pile soared to $334.2 billion in 2024.

The rise was attributable to the company’s short-term investments in U.S. Treasury bills, which jumped to $286.47 billion.

At the end of the third quarter, the company had about $325.2 billion in cash.

Berkshire Chairman Warren Buffett assured investors the company would always allocate most of the money to equities.

“Berkshire will never prefer ownership of cash-equivalent assets over the ownership of good businesses, whether controlled or only partially owned,” Buffett said.

However, Berkshire’s holdings in public companies fell to $272 billion from $354 billion.

Buffett added that the company’s non-quoted controlled equities increased somewhat and “remains far greater” than the value of its equity holdings in publicly traded companies.

The company also said it would likely increase its ownership interests in Japanese firms Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo.

Buffett said the investments are for the “very long term”, and the five companies have agreed to moderately relax the limit that had capped Berkshire's holdings below 10% in the respective stocks.

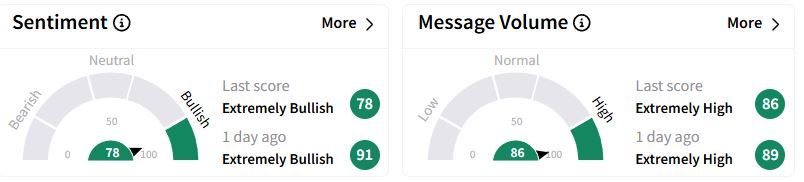

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ (78/100) territory, albeit with a lower score than a day ago, while retail chatter was ‘extremely high.’

One user said that the rise in cash reflects Buffett's commitment to “conservative investment practices” and puts him in a position to take advantage of potential opportunities in alternative equities, which he seems to be struggling to find.

Berkshire's fourth-quarter operating earnings jumped 71.3% to $14.52 billion, aided by strong earnings from its insurance businesses.

Its insurance underwriting income more than quadrupled to $3.40 billion during the fourth quarter. The company saw growth in its vehicle insurance provider Geico’s earnings.

The company’s insurance businesses are expected to take $1.3 billion in charges from the California wildfires.

Over the past year, Berkshire class B shares have gained 17%.

Also See: Top 5 Auto Stocks That Took Over Retail Trader Conversations Last Week

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)