Advertisement|Remove ads.

DigitalOcean Defies Market Slump As Stock Jumps Over 11% On Q4 Earnings Beat – Retail Applauds Resilience

DigitalOcean Holdings Inc. (DOCN) bucked the broader market sell-off on Tuesday, surging over 11% in afternoon trading after the cloud service provider posted stronger-than-expected fourth-quarter earnings.

The rally came even as U.S. equities declined, with inflation concerns and ongoing trade policies weighing on consumer sentiment.

The Conference Board reported that the consumer confidence index dropped to 98.3 in February, missing the Dow Jones estimate of 102.3 and marking the sharpest monthly decline since August 2021.

Meanwhile, the cloud service provider reported earnings of $0.49 per share, beating market expectations of $0.32 per share, according to Koyfin.

Revenue for the quarter hit $204.93 million, exceeding the consensus forecast of $200.57 million.

Sales rose 13% year over year, matching the company's prior growth rate. Management noted that its annual run-rate revenue also increased by 13%, reinforcing expectations of sustained growth into 2025.

For the full year, the company generated revenue of $781 million, up 13% from the previous year.

DigitalOcean projected first-quarter (Q1) 2025 sales of approximately $208 million and earnings of about $0.44 per share – both slightly ahead of Wall Street expectations.

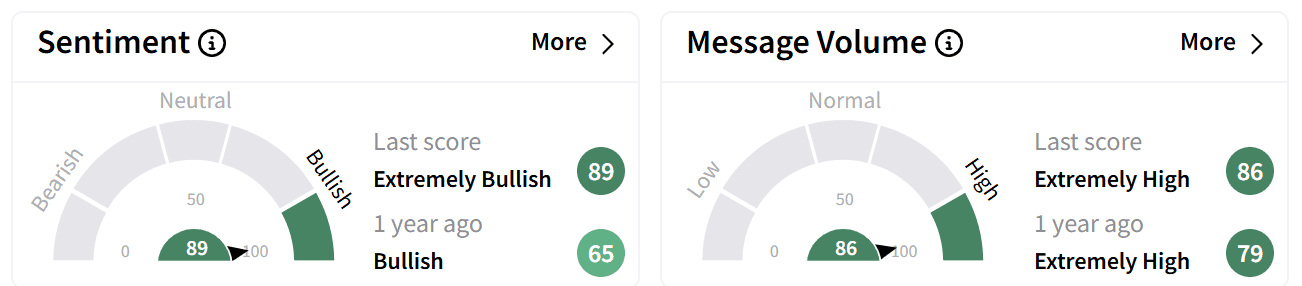

On Stocktwits, retail sentiment around DigitalOcean’s stock surged into the ‘extremely bullish’ (89/100) territory from ‘bullish’ a day ago, accompanied by ‘extremely high’ levels of chatter.

Investors on the platform largely viewed the earnings results favorably.

DigitalOcean shares surged over 20% in early trading, touching an intraday high of $45 before paring gains to trade around $41 in the afternoon session.

The stock is now up nearly 20% year to date, extending its 12-month gains to 11%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242061511_jpg_742d610600.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_hq_resized_af4cc05fd5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_atomera_logo_resized_97a56614c5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)