Advertisement|Remove ads.

Diodes, TI Stocks Outpace Tech Peers After Analyst Upgrades: Retail Traders Upbeat

The market showed volatility on Monday before ending modestly lower as traders reacted to news about President Donald Trump's tariffs. Still, tech stocks finished slightly higher following two sessions of steep losses.

The semiconductor industry led the tech rebound, with the iShares Semiconductor ETF (SOXX) soaring 2.31%.

Two stocks from this industry posted substantial gains after Baird analyst Tristan Gerra upgraded them.

The analyst said the brokerage's semiconductor cycle indicators have turned yellow or blue. He added that this and attractive valuations have prompted Baird to turn constructive on the cyclical or fabbed analog companies. These companies managed pricing soundly during the previous upcycle from 2021-2022.

Gerra noted that lead times have normalized since the second half of 2024. He said that semiconductor stocks typically misbehave on lead times decline, allowing shipments to catch up with demand, which is viewed as a near-term positive for stocks.

"Typically semiconductor stocks start rebounding too early afterwards, while inventory levels remain very high, on cyclical recovery expectations," he added.

Gerra noted that pricing for cyclical components such as microcontroller units (MCUs) and analog have retraced more than halfway from their 2022 peak. Additionally, he said capex significantly declined following a 20% peak.

Although Texas Instruments, Inc. (TXN) has been a notable exception, Gerra said its capital intensity will start declining in 2026.

Among the other indicators, utilization rates were troughing, operation expenditure cuts have been announced and inventory days are closer to normalization, the analyst said.

Gerra upgraded TI and Diodes, Inc (DIOD) to 'Outperform' from 'Neutral.' The analyst has a $175 price target for TI, while he reduced the price target for Diodes stock to $50 from $72.

The price targets imply 14% and 36% upside potential, respectively, for TI and Diodes.

While TI manufactures chips for electronics designers and manufacturers, Diodes makes application-specific standard products in the broad discrete, logic, analog, and mixed-signal semiconductor markets.

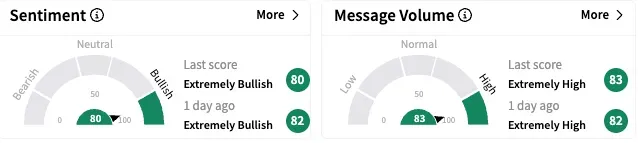

On Stocktwits, retail sentiment toward TI stock remained 'extremely bullish' (80/100), and message volume was also 'extremely high.'

A bullish user said the company is in a "build mode" based on the company's U.S. hirings.

Pointing to BofA Securities naming TI as the U.S.-based manufacturing tariff play, another user said he was bullish on the stock.

By late Monday, retail sentiment toward Diodes dipped to 'bullish' (64/100) from the 'extremely bullish' mood a day earlier. However, message volume stayed 'extremely low.'

TI ended Monday's session up 1.72% at $154, and Diodes stock rallied 4.50% to $36.68. This year, the shares are down over 3.5% and 40%, respectively.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2237643016_jpg_17a9a7eb9d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221557373_jpg_2cb3ed82cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2251311021_jpg_31a407e714.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aluminum_resized_jpg_6efa759339.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)