Advertisement|Remove ads.

Janover Stock Soars 650% as Former Kraken Execs Take Helm, Eye Crypto Push Starting with Solana: Retail’s Excited

Janover, Inc. (JNVR) stock spiked higher, accompanied by a volume spurt, after the software-as-a-service company disclosed plans to invest in digital assets, including Solana.

The Boca Raton, Florida-based company said it raised about $42 million by offering convertible notes and warrants to an investor group comprising Pantera Capita and cryptocurrency exchange Kraken.

The convertible notes will accrue a 2.5% interest rate per year, with the interest payable in cash quarterly in arrears, and mature on April 6, 2030.

The convertible notes can be converted any time before the maturity date, provided that the market cap equals or exceeds $100 million on the day before the conversion date.

Separately, Janover said an all-former Kraken team has acquired majority ownership in Janover. Ex-Kraken chief strategy officer Joseph Onorati took over as Chairman and CEO of Janover, and Parker White, another former Kraken executive, assumed the role of Chief Investment Officer and Chief Operating Officer.

Marco Santori, former Chief Legal Officer of Kraken, will also join the board.

Onorati and White are part of the control group that acquired 728,632 shares of common stock and all 10,000 outstanding shares of Series A Preferred Stock of Janover.

Janover said its board has adopted a treasury policy under which the principal holding in its treasury reserve on the balance sheet will be allocated to digital assets, starting with Solana (SOL.X).

CEO Onorati said, “After building in the crypto industry for more than a decade, we are at a tipping point in mass DeFi adoption. We’re proud to be the first to introduce a digital asset treasury strategy in the US public markets initially focused on Solana.”

Janover said it will continue operating its core business, which continues its transition to a SaaS business model. The company's artificial intelligence-powered online platform connects the commercial real estate industry by providing data and software subscriptions as well as value-add services to multifamily and commercial property professionals.

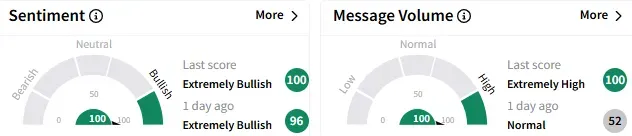

On Stocktwits, retail sentiment toward Janover stock remained ‘extremely bullish’ (100/100), with the degree of positivity improving from a day ago. The message volume on the stream perked up to ‘extremely high’ levels.

A bullish user called Janover as the first U.S. Solana proxy stock.

SOL is the native currency of the Solana blockchain platform, which uses a proof-of-stake mechanism to provide smart contract functionality.

While Janover rallied, SOL slid nearly 2% on Monday.

Another user said they expect more gains for Janover stock.

Janover stock traded up over 575% at $27.50 by Monday afternoon.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Wall Street Divided On AT&T Stock, But Retail Braces For Rally Following Q1 Print

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)