Advertisement|Remove ads.

Discover Financial, Capital One Stocks Slip Over Reports Of DOJ’s Concerns On Pending Merger, Retail Looks For Clues

Discover Financial Services (DFS) and Capital One Financial (COF) stocks fell on Monday after reports said that the U.S. Department of Justice (DOJ) had concerns regarding the $35 billion merger of the two companies.

According to a Bloomberg report, traders cited a story by The Capitol Forum as the reason for the stocks’ decline. The report said the Justice Department staff believed the deal would be anti-competitive in the subprime sector.

Discover shares fell 6.9%, while Capital One fell 3.9% on Monday after paring some losses during the session.

A Capital One spokesperson told Bloomberg that the merger remained “well-positioned to gain approval.”

According to the Bloomberg report, citing a person familiar with the matter, the department has not determined how to proceed yet, and the companies have not yet met with the department’s leadership to advocate for the deal.

Capital One and Discover’s shareholders voted in favor of the deal in February. However, the merger has yet to receive approval from the Federal Reserve and the Office of the Comptroller of the Currency.

In October, New York Attorney General Letitia James had urged a state court to issue subpoenas to Capital One related to an antitrust case on the merger. The two companies have a combined $16 billion in credit card loans in New York.

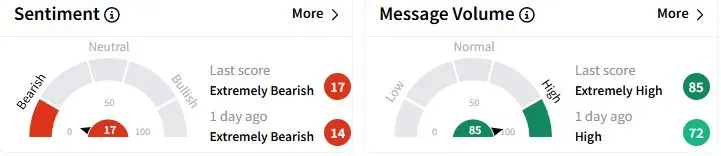

Retail sentiment about Discover on Stocktwits remained in the ‘extremely bearish’ (17/100) zone, while retail chatter rose to ‘extremely high’ levels.

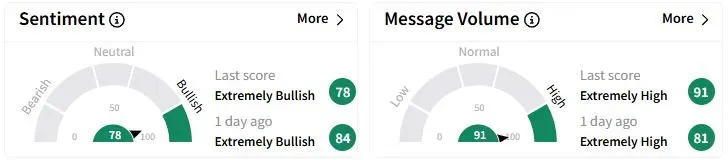

Retail sentiment about Capital One remained in the ‘extremely bullish’ (78/100) territory, albeit with a lower score than a day ago, while retail chatter was at ‘extremely high’ levels.

Users were left wondering what had gone wrong. One trader wondered if President Donald Trump had moved to block the deal, while another user said the stocks would bounce and described the Trump administration as ‘pro-monopoly.’

Year-to-date (YTD), Discover Financial and Capital One shares have fallen 11.7% and 7.3%, respectively.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)