Advertisement|Remove ads.

Diwali Muhurat Stock Pick: Aditya Birla Capital Has Room To Rally Another 30%, Says Analyst

Aditya Birla Capital has emerged as a top Diwali Muhurat pick this year, with SEBI-registered analyst Financial Independence flagging it as a potential breakout candidate.

The stock, which has already gained 70% in 2025, has crossed a crucial 7-year resistance zone.

What are the technical charts showing?

AB Capital stock has broken above its 7-year consolidation zone with strong bullish candles and rising volume, which is a sign of a classic long-term structural breakout. Its previous resistance near ₹255 (2017 supply zone) has now turned into strong support after a clean monthly close above it.

Financial Independence added that its price action shows higher highs and higher lows on the monthly chart, confirming a multi-year uptrend. Additionally, volume expansion since late 2023 further validates institutional accumulation.

Momentum indicators are also likely to turn positive, indicating trend strength.

How should investors trade AB Capital now?

According to Financial Independence, the stock has strong support around ₹255–₹275, meaning it's less likely to fall below this zone soon. If the uptrend continues, they believe that it could first reach around ₹340. The bigger target was identified at ₹385–₹400, which means a potential 30% gain from the current price.

They said that if AB Capital sustains above ₹280–₹285 for a few weeks, it can enter an accelerated phase toward ₹340+. However, any monthly close below ₹255 would invalidate this breakout structure.

Financial Independence advised traders to look at minor pullbacks toward ₹275–₹285 as buy-on-dip opportunities in the medium term.

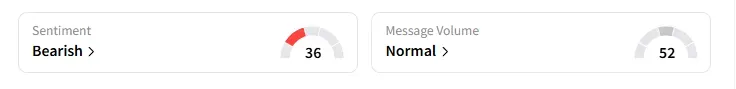

What is the retail mood on Stocktwits?

Data on Stocktwits showed that retail sentiment has been ‘bearish’ for a few weeks on this counter.

AB Capital shares have seen a tremendous rally in 2025, surging 70% year-to-date (YTD).

Disclaimer: The views and opinions expressed are those of the SEBI-registered analyst/advisor mentioned in the article, and are not endorsed by Stocktwits. This is not investment advice. Please do your own research or consult a financial advisor.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231498932_jpg_bdd44fc548.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AEHR_chip_maker_3698bf2343.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870269_jpg_b38339787f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)