Advertisement|Remove ads.

US Election 2024: Trump Media, Phunware, Rumble Stocks Soar Post-Election — But Retail Is Divided

Trump Media & Technology Group Corp. ($DJT) stock surged as much as 35% before markets opened on Wednesday after Republican candidate Donald Trump secured the presidency for a second term, crossing the 270 electoral vote threshold.

DJT, seen as a market proxy for Trump, rallied despite a surprise earnings statement after the bell that showed the company lost $19.2 million in the third quarter.

Shares of mobile-advertising software company Phunware ($PHUN) were also up over 25% premarket on Wednesday in reaction to Trump’s victory in the 2024 US Election. Phunware developed and launched a mobile app for the Trump-Pence 2020 re-election campaign.

Earlier this week, Phunware also announced a deal to acquire a controlling stake in MyCanvass, a subsidiary of Campaign Nucleus that provides voter and advocacy engagement tools, including mobile apps.

Campaign Nucleus is a software-as-a-service (SaaS) platform founded by Brad Parscale, who served as the digital director for Trump’s 2016 campaign and the manager of his 2020 campaign.

Trump-linked Rumble ($RUM) also saw its stock jump by as much as 8% premarket on Wednesday. The company has positioned itself as a conservative alternative to YouTube, so investors believe the stock would benefit from a Trump victory in the election.

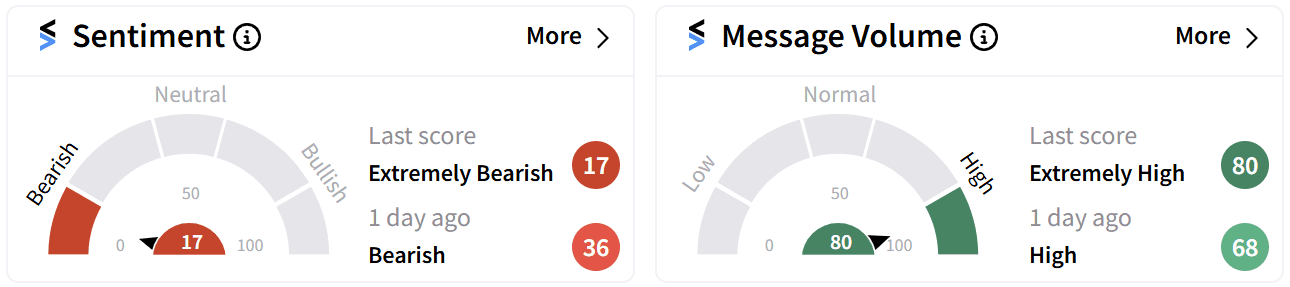

Retail sentiment around DJT dipped to ‘extremely bearish’ (17/100) before markets closed on Tuesday while sustaining ‘extremely high’ (80/100) message volume.

Users on Stocktwits remain divided, some anticipating further gains, while others expect profit-taking to trigger a pullback at market open.

The parent company of Trump’s social media enterprise, Truth Social, which trades under the ticker symbol of the president’s initials, DJT, is majorly owned by Trump.

If pre-market gains hold, it could reportedly boost Trump’s stake in the company to $5.1 billion, according to Barron’s.

Despite the political excitement, DJT’s fundamentals tell a different story. Revenue for the third quarter came in at $1.01 million, a slight drop from $1.07 million in the same quarter last year.

The company’s balance of cash, cash equivalents, and short-term investments was at $672.9 million with no debt marking a sharp rise from $344 million in the second quarter, thanks to stock sales.

DJT has more than doubled in value this year, gaining 167% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_M_and_A_deals_acquisitions_resized_jpg_a56d5b5e28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_semtech_logo_resized_jpg_f9b0e1e71e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ross_stores_resized_jpg_e7e996e005.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2252956558_jpg_2dc0e5e537.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moderna_covid_jpg_3eb7363e71.webp)