Advertisement|Remove ads.

Dick’s Sporting Goods Raises Full-Year Outlook After Upbeat Earnings: So Why’s Retail Bearish?

Dick’s Sporting Goods (DKS) on Wednesday posted impressive Q2 results, beating Wall Street expectations and raising its full-year outlook. However, the stock fell 0.7% in pre-market trading on Wednesday.

Dick’s reported adjusted EPS of $4.37, surpassing the $3.83 estimate, and sales of $3.47 billion, slightly above the $3.43 billion forecast.

The company delivered a 4.5% growth in comparable sales, driven by increased average ticket sizes and higher transaction volumes.

CEO Lauren Hobart highlighted the company’s solid performance, noting gross margin expansion and SG&A leverage that contributed to an EBT margin of nearly 14%.

Dick’s raised its 2024 guidance, projecting comparable sales growth of 2.50%-3.50%, up from the previous range of 2.00%-3.00%.

The company also increased its full-year EPS guidance to a range of $13.55 to $13.90, but it was slightly below the consensus estimate of $13.79 at the midpoint.

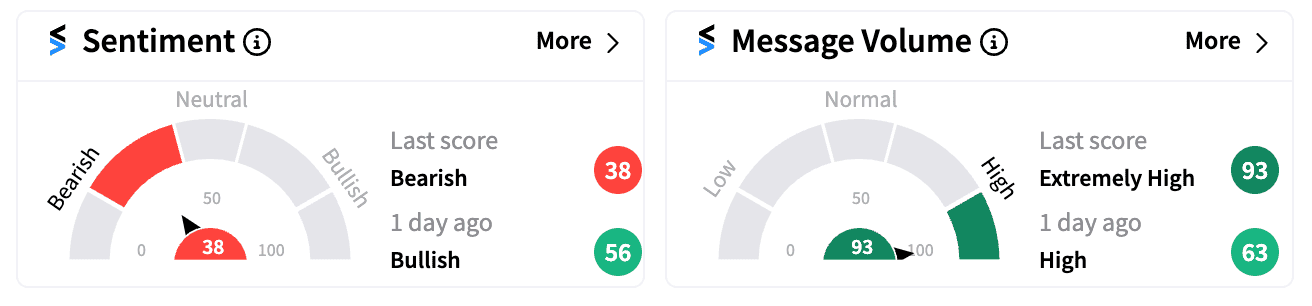

Investor sentiment on Stocktwits was ‘bearish’ (38/100) before the market open.

The tepid reaction may stem from broader industry concerns as peers like Foot Locker and Lululemon have issued cautious outlooks, citing uncertain macroeconomic conditions and shrinking discretionary spending as the November presidential election approaches.

Last month, the company also disclosed unauthorized third-party access to its information systems, including confidential data. While the retailer took immediate steps to investigate and contain the threat, and reported the breach to federal law enforcement, the incident raised concerns about potential operational risks.

While retail sentiment may be bearish, Dick’s stock has risen 58% this year through Tuesday’s close, reflecting investor confidence in an otherwise uncertain economic environment.

Read Next: Dollar Tree Stock Plunges On Disappointing Earnings And Outlook: Retail Turns More Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)