Advertisement|Remove ads.

DocuSign Stock In Spotlight On Expanded Cognizant Partnership: Retail Stays Positive

DocuSign, Inc. (DOCU) stock may draw significant attention on Monday following an expanded tie-up with IT consulting and outsourcing giant Cognizant Technology Solutions Corp. (CTSH).

Teaneck, New Jersey-based Cognizant said Friday it has expanded the existing 360-degree partnership with intelligent agreement management (IAM) company DocuSign.

Under the expanded partnership, the companies will work to provide innovative IAM solutions that optimize customer service management and streamline agreement processes globally.

Specifically, Cognizant and DocuSign will focus on real-time customer assistance, training to help customers deploy DocuSign solutions, expanded back-office support to enhance service management and onboarding new customers.

Kelly Morgan, chief customer officer of Docusign, said, “Together we have the opportunity to expedite the advancement of our Docusign IAM platform and deliver more intelligent and efficient solutions to our customers.”

Anurag Sinha, senior vice president and business unit head of communications, media and technology at Cognizant said, "By introducing advanced digital solutions, we are optimizing service delivery and ensuring Docusign's customers receive the support they need."

In mid-March, DocuSign reported forecast-beating fourth-quarter results and issued positive guidance.

On Stocktwits, sentiment toward DocuSign stock remained ‘bullish’ (59/100) but message volume was ‘extremely low.’

A bullish watcher said they braced for long-term gains for the stock.

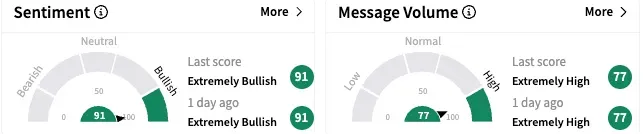

Sentiment toward Cognizant stock stayed ‘extremely bullish' (91/100), with the message volume at ‘extremely high’ levels.

DocuSign stock ended Thursday’s session down 1.72% at $75.42, and it has lost 16% for the year-to-date period. Cognizant is down a more modest 9% this year.

The Koyfin-compiled consensus price target of $92.95 for DocuSign stock suggests it trades at a 19% discount to current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2238737789_jpg_eca1ed4bd9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)