Advertisement. Remove ads.

Dollar General Stock Top Premarket Loser On Earnings Miss, Dismal Outlook: Here’s How Retail Is Reacting

Shares of Dollar General Corp. (DG) plummeted nearly 25% to become the top loser in Thursday’s pre-market session and are potentially set to open at their lowest level since June 2018, following a disappointing earnings report and a downward revision to its full-year outlook.

The discount retailer, a staple in rural America, now faces renewed skepticism about its turnaround strategy as it struggles to fend off competition and adapt to a challenging economic environment.

The company’s Q2 earnings missed Wall Street expectations, with net sales coming in at $10.21 billion, below the $10.37 billion estimate, while earnings per share (EPS) stood at $1.70, below the forecast of $1.79.

Comparable sales rose just 0.5% for the quarter, significantly underperforming analysts’ projections.

Dollar General slashed its full-year sales forecast, now expecting comparable sales to rise between 1% and 1.6%, down from its previous guidance of 2% to 2.7%.

The company also reduced its annual EPS guidance to between $5.50 and $6.20, compared to the earlier forecast of $6.80 to $7.55. This stands in stark contrast to competitors like Target and Walmart, which recently raised their full-year profit forecasts as they effectively attract price-sensitive customers through aggressive discounting.

Dollar General CEO Todd Vasos acknowledged the challenges facing the company, noting, “Despite advancing several of our operational goals and driving positive traffic growth, we are not satisfied with our financial results.”

Vasos attributed the weaker performance in part to “a core customer who feels financially constrained,” but stressed the importance of focusing on controllable factors.

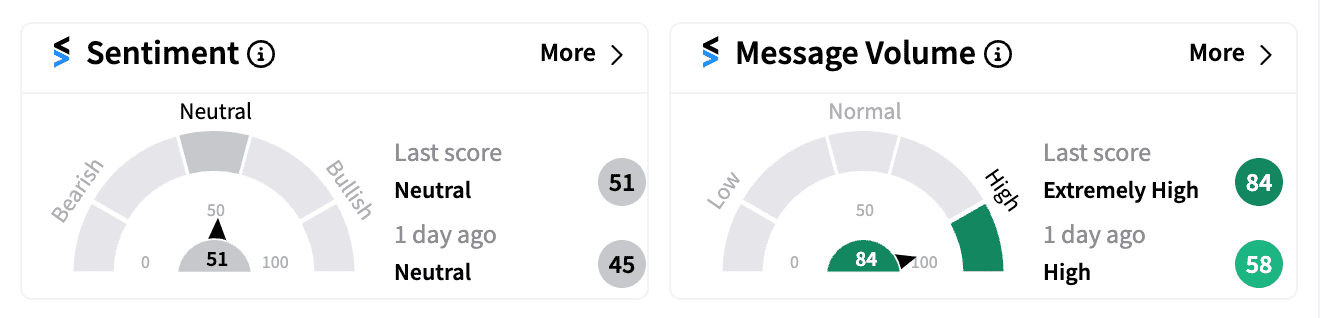

On Stocktwits, retail sentiment for DG remained ‘neutral’ (51/100) as investors digest the company’s commentary.

One ‘bearish’ user suggested that Dollar General’s rapid expansion might be part of the problem.

The retailer’s struggles come amid a broader effort to address operational issues. Last month, Dollar General agreed to a $12 million settlement with U.S. safety regulators to resolve long-standing concerns about store conditions.

Shares of Dollar Tree Inc. (DLTR), set to report its Q2 results next week, dropped nearly 10% in pre-market trading, indicating a ripple effect from DG’s disappointing outlook.

Read Next: Lululemon Keeps Retail Investors On Edge Ahead Of Q2 Earnings: What’s Wall Street Expecting?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209252202_jpg_c5858a6a72.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hamas_bombing_OG_jpg_4e19be8009.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_microsoft_office_jpg_db5ba55187.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bulls_versus_bears_stock_market_jpg_c083ddc168.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215271287_jpg_e254182ae0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)