Advertisement|Remove ads.

Dollar Tree Stock Rises As Analysts Get Bullish — Retail Crowd Starts To Buy In Too

Dollar Tree (DLTR) shares climbed 2% on Monday, extending their winning streak to a fourth straight session following a wave of upbeat analyst actions from Wall Street.

Barclays upgraded its rating on the company's shares to 'Overweight' from 'Equal Weight,' and raised its price target by $25 to $120. The latest target indicates a nearly 7% upside to the stock's last close.

JPMorgan also raised its price target to $138 from $111, and added Dollar Tree to its Analyst Focus list, a monthly curation of stocks it considers especially promising.

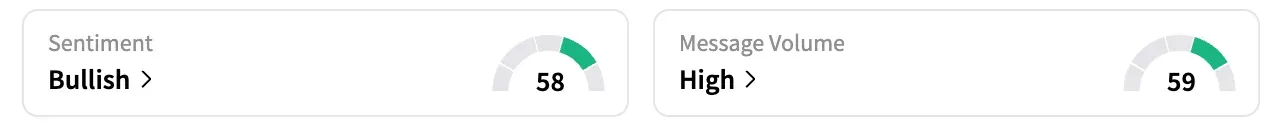

On Stocktwits, the retail sentiment shifted to 'bullish' from 'neutral' the previous day, with message volume also increasing to 'high' from 'normal.'

Dollar Tree shares have experienced a phenomenal rally, rising over 80% from a recent low in March and about 50% year-to-date, consistent with the momentum in the company's business.

High inflation and economic uncertainty under President Donald Trump have prompted consumers to seek budget-friendly options, driving demand for everyday essentials at lower prices. That trend has benefited discount retailers like Dollar Tree.

In its investor note, Barclays noted that consumer "trade-in" behavior and benefits from competitor closings are supporting Dollar Tree, positioning it well through the remainder of fiscal years 2025 and 2026.

The research firm also supported the company's internal initiatives, particularly its multi-price-point strategy, which is resonating with customers while effectively raising prices on the base assortment with minimal impact on volume.

JPMorgan, which also backed the multi-price-point initiative, noted the favourable setup for the business. It raised its forecast for Dollar Tree’s Q2 same-store sales and expects more than $4 billion of share repurchase capacity through FY27.

Dollar Tree announced a $2.5 billion share buyback authorization earlier this month.

Currently, 15 of the 28 analysts covering the stock have a 'hold' rating, 12 have 'buy' or higher, and one has a 'strong sell,' according to Koyfin data. The average price target is $99.30, which is 11.6% below DLTR's last closing price.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Barclays Downgrades Target To ‘Sell’, Says Big Box Retailer Needs A Strategic Overhaul

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233716109_jpg_230d917a7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Alibaba_jpg_4d8d9521c8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_OG_jpg_9d414a2458.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)