Advertisement|Remove ads.

Domino’s CEO Highlights Strategic Delivery Push Driving Market Share Gains, Retail Investors Embrace Growth Story

Domino's Pizza (DPZ) CEO Russell Weiner said on Monday that both the delivery and carryout segments saw growth during the second quarter, which helped the company drive “meaningful” market share in the U.S. pizza quick-service restaurant category.

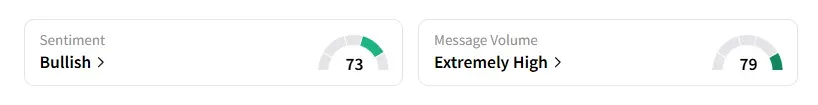

The pizza chain’s shares jumped over 5% in premarket trading on Monday. Retail sentiment on the stock improved to “bullish” from “neutral” with chatter at an “extremely high” level of 79, according to Stocktwits data.

Retail user messages surrounding Domino’s stock surged 100% in the last seven days on Stocktwits heading into the earnings.

In April, Domino’s announced a new partnership with DoorDash (DASH), enabling customers to place orders through the food delivery firm’s app, to strengthen its delivery operations and expand its customer reach across the U.S.

“Internationally, we continued to grow despite macro challenges,” Weiner added. Domino’s had been betting on sales in its other global markets while growth in the U.S. slowed as people cut back even on purchases of pizzas and burgers and were looking to trim expenses by eating at home.

However, in the second quarter, U.S. same-store sales grew 3.4%, compared to 4.8% growth in the same quarter a year ago.

Its total quarterly revenue of $1.15 billion came in line with Wall Street expectations, according to data compiled by Fiscal AI.

Domino’s said the U.S. company-owned store gross margin decreased 2%, driven primarily by higher insurance costs and price hikes on ingredients supplied to the stores.

The company’s quarterly profit per share came in at $3.81, compared to analysts’ estimates of $3.96 per share.

Domino’s stock has risen 11% year-to-date and over 12% in the last 12-months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Morgan Stanley Bets On Yum China, Starbucks In Consumer Space As Earnings Season Kicks Off

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)