Advertisement|Remove ads.

Morgan Stanley Bets On Yum China, Starbucks In Consumer Space As Earnings Season Kicks Off

Morgan Stanley is advising investors to load up on Yum China Holdings (YUMC) and Starbucks (SBUX) as part of a list of stocks the research firm thinks will surge during this earnings season.

According to a report in CNBC, Morgan Stanley analysts expect a range of catalysts to drive those stocks.

It recommends buying the dip in Yum China, which operates Pizza Hut and KFC in China and pays royalties to the parent firm, Yum Brands (YUM).

"We expect SSSG (same-store sales growth) uptick from 2Q25 onward, with potential higher delivery orders as the short-term catalyst," analyst Lillian Lou said, adding that there is significant upside potential in the stock as the long-term growth setup looks good.

Starbucks stock also sees a tempting setup with catalysts like "sales stability, and the broader turnaround narrative, which we think continues to offer more detail, and an increasingly clear vision for what Starbucks should be," analyst Brian Harbour said.

The research firm admitted that the setup is not overly compelling heading into this particular quarterly report, due early next month, but believes that patient shareholders will be rewarded.

Starbucks, amid major efforts to turn its business around, has seen its shares rebound in recent months — a rally that at least one analyst believes may be overdone.

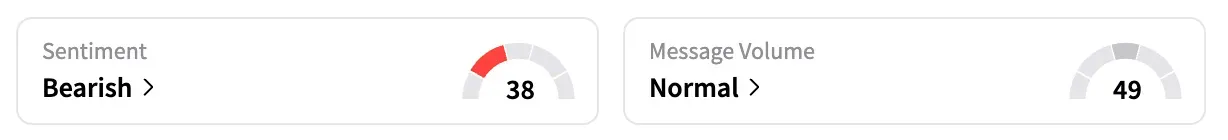

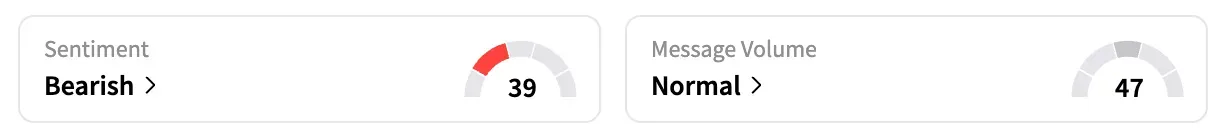

On Stocktwits, the retail sentiment for both YUMC and SBUX remained 'bearish,' unchanged from a week ago. YUMC stock is down 2% year-to-date, while SBUX shares are up 2.5%.

Morgan Stanley also advised taking a position in AT&T (T), O'Reilly Automotive (ORLY), and Clearwater Analytics (CWAN) as part of its top picks list, according to the CNBC report.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)