Advertisement|Remove ads.

DoorDash Upgraded To ‘Strong Buy’ By Raymond James On Underappreciated Deliveroo Upside

Raymond James on Monday upgraded its rating and price target on DoorDash (DASH) shares, citing substantial gains from the company's recent acquisition of Deliveroo.

According to the investor note summary on The Fly, Raymond James believes the market is currently underappreciating the potential upside from the merger, which is expected to close in the fourth quarter.

The investment firm said there is an "attractive $260 target price scenario" with a $350 per share bull case due to "untapped" Deliveroo synergies and a "seemingly growing emphasis" on advertising, consistent execution, and eventual autonomous tailwinds.

The firm forecasts mid-teens EBITDA accretion in 2026 and high-teens in 2027 for DoorDash.

Raymond James upgraded its rating on the company to 'Strong Buy' from 'Outperform' and the price target to $260 from $215. The latest forecast indicates a 13% upside to the latest share price.

Last month, DoorDash agreed to acquire the UK's Deliveroo for $3.8 billion, pending approvals. Following the announcement, several analysts raised their price targets on its stock.

DoorDash's shares are up 12.3% from May 6, when the deal was announced, and 37.3% year-to-date. Currently, analysts have an average price target of $217.74 on the company's stock, according to Koyfin.

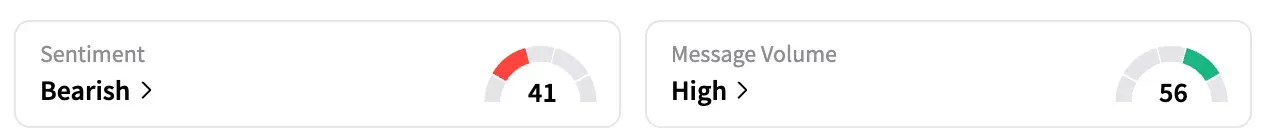

On Stocktwits, the retail sentiment for Doordash shifted to 'neutral' on late Monday from 'bearish' on the previous day.

One user cautioned against the analyst upgrades "when the cashflow is nowhere near proven."

Quick on the heels of the Deliveroo deal, DoorDash also made a $175 million purchase of ad tech platform Symbiosys earlier this month.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_ibm_signage_mwc_resized_28f91e1a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2209881066_jpg_ebc4b9b217.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)