Advertisement|Remove ads.

DoorDash’s November Slump Hasn’t Scared Wall Street Yet — Analysts See A 40% Upside From Here

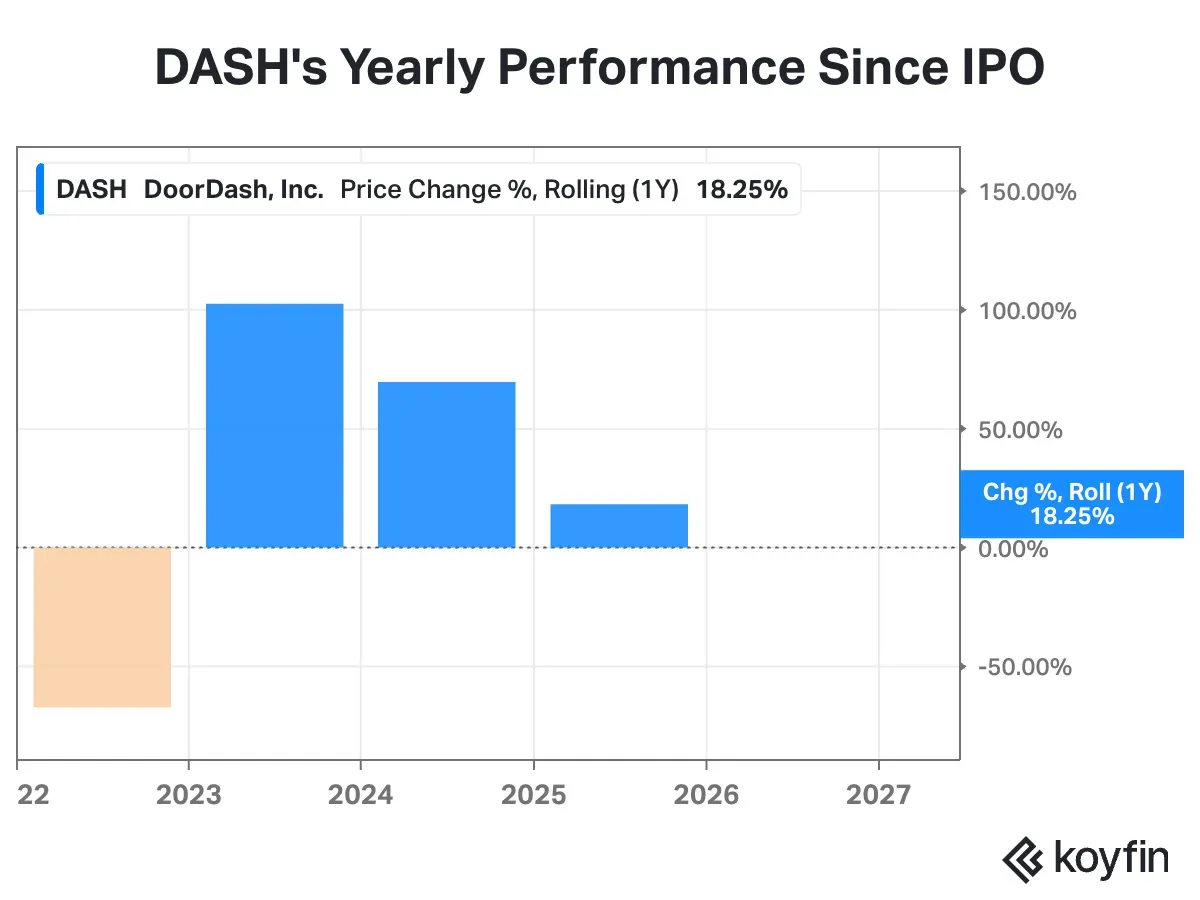

- DoorDash shares lost over 22% last month, their worst performance since April 2022.

- Parts of the market are worried about its spending plans, after it recently closed its mega $3.9-billion Deliveroo deal.

- However, the majority of brokerages recommend buying the stock at this point, especially given the recent sell-off.

DoorDash is one of the more premium stocks in the market, backed by consistent revenue growth of around 25%, a commanding market lead, and significant ongoing technology-led innovation.

So, even as it shed nearly a quarter of its value last month, Wall Street analysts aren’t really hitting the panic button, brokerage positions show. According to Koyfin, 33 of 44 analysts still rate DASH stock ‘Buy’ or higher (the remaining 11 rate it ‘Hold’), with an average upside of about 40% from the stock’s last close.

November Effect?

November trades are essentially about investors reorganizing their portfolios as the year draws to a close, including bets on the next year and, in some cases, booking profits. Before the month began, DASH was up by over 52% year-to-date. Last month was the worst for shares since April 2022.

Should retail investors buy the weakness? For one, DASH rebounded nearly 4% in premarket on Monday, the first trading day of the month. However, the retail sentiment for Stocktwits remained in the ‘bearish’ zone, with ‘low’ message volume.

Investors Fret DASH’s High Spend

The recent weakness comes as DoorDash's spending plans spooked investors. At the start of last month, the company reported third-quarter profit that missed Wall Street estimates and said that it would invest several hundred million dollars more in 2026 on new initiatives.

The company is investing in growth partnerships, including with robotics firm Serve Robotics and companies such as Domino's Pizza, Kroger, and TKO Group. DoorDash also recently completed its $3.9-billion mega-merger with Deliveroo, giving it a launchpad for aggressive expansion in the UK and wider Europe. The move could require upfront cash for longer-term gains — a dynamic that analysts are watching closely.

DoorDash CEO Tony Xu said on the company’s analyst call that Deliveroo might still require investment. Although the company is in a better shape than he imagines, Xu said the near-term focus is on improving product quality — boosting retention, engagement, and frequency — while steadily strengthening unit economics.

Brokerages Upbeat For Long-Term

Last month, Jefferies raised its rating on DoorDash’s shares to ‘Buy’ from ‘Neutral,’ with a $40 price target bump to $260, citing favourable long-term expectations.

DoorDash’s 2026 outlook lowered expectations, which provides "flexibility" for both its long-term investments and upside to consensus estimates, Jefferies analysts wrote in an investor note. They also flagged healthy growth in U.S. deliveries and the recent sell-off as reasons for their rating action.

For now, DASH could be emerging as a value bet on investors’ radar, with moves in the next few days defining the stock's performance this month. For the year to date, DASH is still up about 17%, compared to the 30% gains in the benchmark S&P 500 index.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)