Advertisement|Remove ads.

DoubleVerify Stock Sinks On Lackluster Q4 Results, Weak Quarterly Guidance: Retail Sentiment Plummets

DoubleVerify Holdings, Inc. (DV) shares plummeted in Friday’s premarket session after the digital media measurement, data, and analytics platform provider announced disappointing results for the fourth quarter of the fiscal year 2024 and issued mixed guidance.

The New York-based company reported a fourth-quarter net income of $23.4 million, down from $33.11 million a year ago.

Total revenue rose 11% year over year (YoY) to $190.6 million, missing the consensus estimate of $196.82 million and the guidance of $194 million to $200 million.

On the earnings call, CFO Nicola Allais said the revenue shortfall was due to a slowdown in spending from existing customers that began in October. These customers were diverting spending to political ad spending. Also, one of the company’s largest customers sharply reduced its spending due to rising commodity costs.

This executive noted that the customer suspended its business with the company in early February.

Activation revenue, which accounted for about 58% of the total revenue, increased by 10%. Supply-side revenue jumped 34% to $16.7 million. Social measurement revenue was up a more modest 7% at $64.4 million.

Advertiser revenue rose 9% YoY, with a 14% increase in media transactions measured (MTM) helping to offset a 5% drop in measured transaction fee (MTF) revenue.

DoubleVerify’s quarterly adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were $73.8 million, mostly missing the guidance of $73 million to $79 million.

However, the adjusted EBITDA margin was at a record 39%.

CEO Mark Zagorski said, “DoubleVerify delivered solid full-year results in 2024, with 15% revenue growth, 33% adjusted EBITDA margins, and continued expansion across CTV, Social, and international markets.”

For the first quarter, the company expects revenue and adjusted EBITDA of $151 million to $155 million and $37 million to $41 million, respectively. The revenue guidance trailed the $156.54-million consensus estimate.

The company forecasts 2025 revenue growth of about 10%, which aligns with the consensus, and an adjusted EBITDA margin of about 32%.

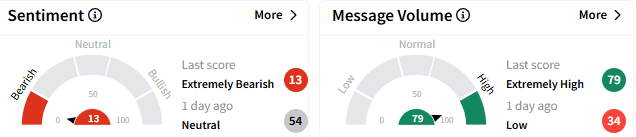

On Stocktwits, retail sentiment toward DoubleVerify stock turned to ‘extremely bearish’ (16/100) from the ‘bullish’ mood that prevailed a day ago. The message volume perked up to ‘extremely high.’

DoubleVerify stock plunged 16.20% to $18.21 in premarket trading. If the losses carry over to the regular session, the stock is on track to record its biggest one-day slide since early May 2024. It had added 13% year-to-date.

For updates and corrections, email newsroom@stocktwits.com

Read Next: Most Retail Investors See AI Server Maker C3.ai Stock As Undervalued After Post-Earnings Dip

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)