Advertisement|Remove ads.

Most Retail Investors See AI Server Maker C3.ai Stock As Undervalued After Post-Earnings Dip

C3.ai, Inc. (AI) stock plunged nearly 10% on Thursday despite the enterprise artificial intelligence software applications company reporting better-than-expected results for the third quarter and issuing in-line forward guidance.

Following the earnings report, several analysts reduced their price targets for the stock, The Fly reported.

Most sell-side analysts tempered their opinions by citing the moderation in revenue growth to 26% from 29% in the previous quarter. Morgan Stanley, which lowered the price target to $30 from $32, said the revenue growth deceleration came after seven quarters of accelerating growth.

The firm also expressed concerns about the wide guidance range for the fourth quarter, especially given the looming uncertainty about the Federal Reserve rate.

KeyBanc analysts reduced their price target to $21 from $29, citing the significant growth in demo licenses that drove the upside. They noted that non-demo subscription revenue experienced an accelerating decline.

DA Davidson fretted about the valuation of the stock, although it believes that new and expanded partnerships with Microsoft Corp. (MSFT), Amazon, Inc 's (AMZN) AWS and McKinsey underline the company’s quickening sales cycle and growing pipeline.

Following the earnings release, we asked Stocktwits users what they think about the valuation of C3.ai stock.

Of the respondents, 31% said the stock is ‘overvalued,’ 22% said the valuation is reasonable and the remaining 47% think the stock is undervalued.

The stock trades at a price/sales ratio of 8.23, roughly in line with the application software industry’s average ratio of 8.8, according to Eqvista

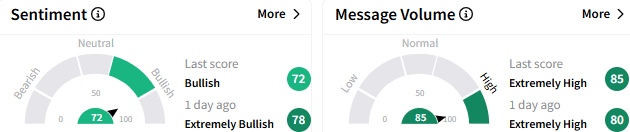

Watchers on the Stocktwits platform are ‘bullish’ about C3.ai stock, and reflecting the retail group's interest, the message volume on the stock stream remains ‘extremely high.’

A bullish user highlighted the company’s balance sheet as the one of the strongest they have seen.

Another user pointed to the company’s $800 million cash position compared to its market cap of $3 billion.

C3.ai stock has lost over 30% so far this year.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Bury_resized_jpg_14e6fc7c2b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)