Advertisement|Remove ads.

Dun & Bradstreet Stock Rallies On $7.7B Acquisition By Clearlake Capital: Retail Cheers The Deal

Shares of Dun & Bradstreet Holdings Inc. (DNB) rose nearly 3% on Monday after Clearlake Capital Group, L.P. said it would be acquiring the company in a transaction valued at $7.7 billion, including its outstanding debt.

Dun & Bradstreet provides business decisioning data and analytics that enable companies worldwide to improve their business performance.

Under the terms of the deal, Dun & Bradstreet shareholders will receive $9.15 in cash for each share of common stock they own. The stock was trading at $8.99 on Monday afternoon.

Clearlake will fund the transaction using a combination of equity and debt financing.

The agreement has also factored in a 30-day “go-shop” period under which Dun & Bradstreet will have the right to terminate the agreement and enter into a superior proposal, subject to the conditions and procedures specified in the merger agreement.

The transaction is expected to close in the third quarter (Q3) of 2025. Upon completion, Dun & Bradstreet will become a privately held company, and its common stock will no longer be listed on any public market.

The Dun & Bradstreet Board has unanimously recommended that its shareholders vote to approve the merger at the upcoming special meeting of shareholders.

Behdad Eghbali, Co-Founder and Managing Partner, and James Pade, Partner at Clearlake, said that as companies become more data-centric in their decision-making, the firm sees vast potential for Dun & Bradstreet to deliver AI-powered solutions to its global client base.

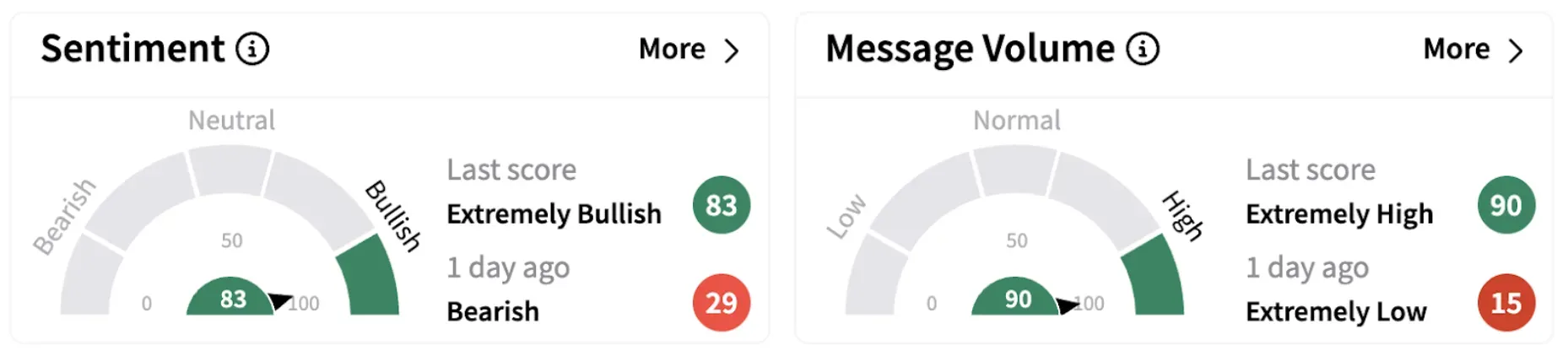

On Stocktwits, retail sentiment flipped into the ‘extremely bullish’ territory (83/100) from ‘bearish’ a day ago. The move was accompanied by year-high message volume.

One Stocktwits user commended the deal.

Another believes the stock is undervalued at current levels.

DNB shares have lost nearly 28% in 2025 and are down over 6% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2257248307_jpg_6720435e43.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2248586785_jpg_9c6ef18a07.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)