Advertisement|Remove ads.

DuPont Stock Surges Pre-Market On Q4 Earnings Beat, Raises 2025 Profit Forecast Ahead Of Electronics Business Spin-Off: Retail Sentiment Soars

Shares of DuPont de Nemours (DD) surged more than 5% in pre-market trade on Tuesday after the company’s fourth-quarter earnings surpassed Wall Street expectations.

DuPont posted earnings per share (EPS) of $1.13 during the fourth quarter, ahead of consensus estimate of $0.98, according to Stocktwits data. It has now beaten earnings expectations for the past five consecutive quarters.

The Delaware-headquartered chemical giant also beat revenue expectations by a whisker, posting $3.09 billion during the quarter, compared to an estimated $3.07 billion.

DuPont benefited from the growing semiconductors market—its electronics and industrial unit posted 10.6% year-on-year sales growth, compared to a 6.4% increase in the water and protection business.

The company said it now plans to spin off only the electronics business and expects to complete this process by November this year.

“We also remain excited for and confident in DuPont's value creation opportunities following the Electronics separation, centered around the high growth businesses of Water and Healthcare, along with other market-leading industrial product lines,” said DuPont CEO Lori Koch.

DuPont guided $12.8 billion to $12.9 billion in revenue for the fiscal year 2025 and raised its EPS guidance to $4.30 to $4.40. Analysts expect the company to post an EPS of $4.31, according to FinChat.

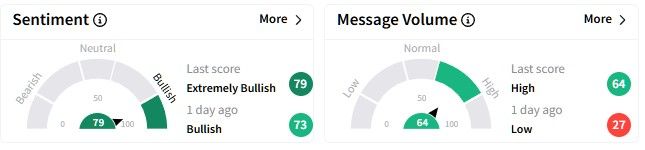

On Stocktwits, retail sentiment around the DuPont stock soared, entering the ‘extremely bullish’ (78/100) territory, while message volume also surged to ‘extremely high’ levels.

DuPont’s share price has witnessed a sideways movement, declining by 2.6% over the past six months.

In contrast, DuPont’s stock has gained over 11% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263849665_jpg_4d6eff48f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)