Advertisement|Remove ads.

TSMC Stock Edges Lower Pre-Market On Slower January Sales Due To Earthquake In Taiwan: Retail Stays Bearish

Shares of Taiwan Semiconductor Manufacturing Co. (TSMC) edged lower by over 1% in pre-market trade on Tuesday after the chipmaker posted lower-than-expected growth in its January sales.

TSMC’s January revenue came in at $8.93 billion, rising 5.4% sequentially and 35.9% on a year-on-year basis. This was a considerable slowdown from the 57.8% year-on-year revenue growth posted by the company in December.

TSMC highlighted that the 6.4-magnitude earthquake that hit Taiwan in January cost the company about $161 million in estimated losses. However, it disclosed that none of its factories had sustained any structural damages.

“A certain number of wafers in process were impacted and had to be scrapped due to the earthquake and aftershocks,” TSMC said.

As a result of the earthquake, the chipmaker expects its revenue for the first quarter of fiscal year 2025 to be closer to its guidance of $25 billion and $25.8 billion. However, it expects to maintain its gross profit margin of 57% to 59% during the quarter.

Further, a report by Reuters states that Sam Altman-led OpenAI is finalizing the design of its first custom chipset as it looks to reduce reliance on Nvidia Corp. (NVDA). The report adds that OpenAI will send its chip design to TSMC for fabrication.

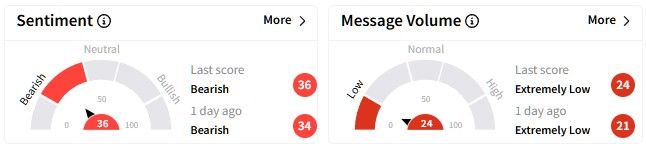

Retail sentiment on Stocktwits around the TSMC stock was in the ‘bearish’ (37/100) territory, slightly edging up from the previous day.

One user posted a technical analysis of the TSMC stock, underscoring their bearish thesis.

TSMC’s share price has gained more than 24% over the past six months, while its gains over the past year stood at over 59%.

1 NTD = 0.03 USD

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Gorilla Technology Stock Pops On Closure Of ATM Program: Retail Remains Extremely Bullish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_warner_bros_discovery_wbd_resized_jpg_bae2c7edb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Sam_Altman_1200pi_resized_jpg_a180a65511.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202831815_jpg_e9c998f956.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_b1a99c6298.webp)