Advertisement|Remove ads.

eBay Stock On Track For Best Day In 7 Years After Q2 Beat, Strong Outlook Amid Tariff Worries: Retail Turns More Bullish

Retail sentiment for eBay, Inc. (EBAY) climbed late Wednesday after the specialty e-commerce company reported better-than-expected second-quarter results and offered an upbeat forecast.

Ebay shares jumped more than 11% in after-hours trading, and if the momentum carries into Thursday's session, it would mark the stock's highest intraday gain since January 2018.

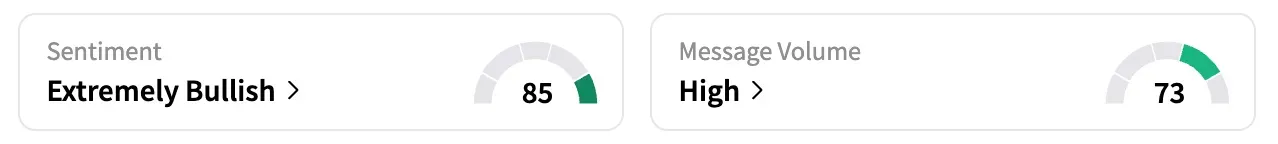

On Stocktwits, the retail sentiment for the company's shares shifted to 'extremely bullish' (85/100) from 'bullish' the previous day. Message volume surged over 300% in the last 24 hours.

Revenue rose 6% to $2.73 billion, beating analysts' expectation of $2.64 billion. Gross merchandise value (GMV), or the total dollar value of transactions on the platform, rose 6%.

Adjusted profit was $1.37 per share, also ahead of expectations of $1.30.

“Our marketplace has proven resilient to recent uncertainty brought on by tariffs and trade policy changes," CEO Jamie Iannone said in the post-earnings conference call.

The management indicated that the company's artificial intelligence tools, including the AI shopping agent and AI video tools for sellers, were showing "tangible" gains “on our P&L,” according to Iannone's comments to CNBC.

Ebay, which competes with Amazon, Walmart, and Etsy, has pivoted in recent years to focus on enthusiast-driven categories like sneakers, trading cards, and high-end goods such as watches and handbags, as well as refurbished products.

Analysts say that is partly why eBay faces relatively less pressure from macroeconomic headwinds than other platforms, where consumers mainly shop for electronics and essentials, among other things.

Ebay's strong report suggests that consumers still have a decent amount of disposable income, despite broader economic challenges, a Stocktwits user noted.

Another retail watcher noted a surge in put options, signaling expectations of a decline in the stock price.

For the third quarter, the company expects revenue to be in the range of $2.69 billion to $2.74 billion, exceeding Wall Street's expectations of $2.66 billion. Adjusted per-share earnings are forecast to be between $1.29 and $1.34, slightly higher than expectations of $1.31.

Ebay’s third-quarter GMV is expected to be in the range of $19.2 billion to $19.6 billion, higher than consensus estimates of $18.8 billion. The guidance takes into account "potential disruptions from impending tariffs and the potential elimination of remaining de minimis exemptions."

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Carvana's Strong Q2 Print Reignites Retail Trader Concerns Over Inflated Numbers

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)