Advertisement|Remove ads.

Elevance Health Stock Slips Pre-Market After Slashing Full-Year Earnings Guidance: Retail Now Eyes UnitedHealth Q2 Results

Shares of Elevance Health, Inc. (ELV) declined in the pre-market session on Thursday morning after the company reported second-quarter earnings that fell below Wall Street expectations and reduced its full-year guidance due to increasing medical costs.

ELV shares fell as low as 7% in the pre-market before paring some of their losses.

The health insurer now expects its adjusted net income per diluted share to be approximately $30.00, down from its previous guidance of $34.15 to $34.85. Analysts were expecting $34.15, according to data from Fiscal AI.

The company pegged the change in forecast to the ongoing and industry-wide impact of elevated cost trends in Affordable Care Act plans and slower alignment rate in Medicaid.

For the second quarter, the company reported operating revenue of $49.4 billion, up 14.3% from the same quarter in 2024, and exceeding an analyst estimate of $48.20 billion.

Adjusted and diluted earnings per share for the quarter came in at $8.84, below an expected $8.92.

The company’s medical cost ratio, or the percentage of premiums spent on medical care, increased by 260 basis points year-over-year to 88.9% in the quarter, reflecting a higher medical cost trend, the company said.

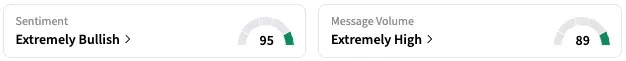

On Stocktwits, retail sentiment around ELV stayed unmoved within ‘extremely bullish’ territory over the past 24 hours while message volume increased from ‘high’ to ‘extremely high’ levels.

Retailers on Stocktwits are now looking forward to UnitedHealth Group’s (UNH) earnings, slated for July 29.

UNH usually kicks off the earnings season for health insurers in the U.S.

UNH withdrew its full-year guidance earlier this year over higher costs. Centene Corp (CNC) and Molina Healthcare (MOH), likewise, have also withdrawn or slashed their full-year guidance since.

ELV stock is down by 7% this year and by about 34% over the past 12 months.

Read Next: PepsiCo Strips Artificial Colors From Lay’s, Tostitos, But Retail Investors Remain Wary

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)