Advertisement|Remove ads.

Eli Lilly’s Alzheimer’s Drug Gets US FDA Label Update For More Gradual Dosing After Study Shows Reduced Side Effects

Eli Lilly and Company (LLY) announced on Wednesday that the U.S. Food and Drug Administration (FDA) has approved a label update for its Alzheimer’s drug Kisunla with a new recommended dosing schedule to reduce side effects.

Eli Lilly’s shares were up 0.5% in Wednesday’s pre-market trading session.

Alzheimer's disease is a progressive neurodegenerative disorder that impairs memory, thinking, and behavior. It is characterized by the buildup of abnormal protein deposits or amyloid plaques in the brain, leading to nerve cell damage and loss.

The U.S. FDA approved Kisunla, an amyloid-targeting therapy, in July 2024 after a study showed that it significantly slowed cognitive and functional decline in Alzheimer’s patients who were less pathologically advanced in their disease.

The new recommended dosing regimen for Kisunla differs from the original dosing by shifting a single vial from the first dose to the third dose, delivering the same amount of Kisunla by week 24.

The modified titration schedule significantly lowered the incidence of amyloid-related imaging abnormalities with edema/effusion (ARIA-E), or a type of brain abnormality characterized by edema (swelling) and/or effusion (fluid buildup) in the brain tissue, versus the original dosing schedule at 24 and 52 weeks, while still achieving similar levels of amyloid plaque removal in a study.

ARIA-E is a side effect of amyloid plaque-targeting therapies, including Kisunla, detected by Magnetic Resonance Imaging (MRI). ARIA-E is usually asymptomatic, although serious and fatal events can occur.

"We are confident that this label update for Kisunla will significantly aid healthcare professionals in evaluating appropriate treatment options for their patients," stated Brandy Matthews, Lilly's Vice President of Global & US Medical Affairs for Alzheimer's Disease.

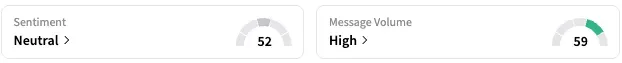

On Stocktwits, retail sentiment around LLY jumped from ‘bearish’ to ‘neutral’ territory over the past 24 hours, while message volume rose from ‘low’ to ‘high’ levels.

LLY stock is up by about 1% this year but down by about 17% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)