Advertisement|Remove ads.

LLY Stock Surges On Q4 Beat – Obesity, Diabetes Drugs Drive Strong FY26 Outlook

- Eli Lilly issued a revenue guidance between $80 billion and $83 billion for fiscal 2026

- For the full year 2025, Eli Lilly’s revenue grew 45% to $65.18 billion.

- CFO Lucas Montarce said the company expects to launch the multidose Zepbound within the next 30 days, according to a Bloomberg report.

Shares of Eli Lilly (LLY) jumped 8% in pre-market trading on Wednesday, after the company reported better-than-expected fourth-quarter results and issued a revenue guidance between $80 billion and $83 billion for fiscal 2026, significantly above fiscal 2025 revenue.

LLY shares were up 9.2% after the opening bell.

Fourth-quarter revenue surged 43% to $19.3 billion, driven by volume growth from Mounjaro and Zepbound – signalling sustained momentum in its obesity and diabetes portfolio. Analysts had expected a revenue of $17.86 billion, according to Fiscal.ai data. Meanwhile, Q4 earnings increased by 51% to $7.39 per share on a reported basis, compared to Street estimates of $7.22 per share.

For the full year, Eli Lilly’s revenue grew 45% to $65.18 billion. LLY expects earnings of $33.50 to $35 per share for full-year 2026.

Mounjaro And Zepbound Drive Revenue Growth

Global revenue for Mounjaro surged 110% to $7.4 billion in Q4 2025, with U.S. sales rising 57% to $4.1 billion on strong demand despite lower realized prices. International revenue jumped to $3.3 billion from $899 million a year earlier, driven mainly by volume growth.

U.S. Zepbound revenue climbed 122% to $4.2 billion, fueled by higher demand but partially offset by pricing pressure. Meanwhile, revenue from Verzenio, Eli Lilly’s drug to treat metastatic breast cancer, edged up 3% to $1.6 billion.

Eli Lilly’s Product Pipeline

After the FDA authorized Lilly to market Zepbound in a multidose device last month, CFO Lucas Montarce said the company expects to launch the multidose pen within the next 30 days, according to a report by Bloomberg on Wednesday.

In an interview with CNBC last month, CEO Dave Ricks said the upcoming Medicare coverage for obesity drugs could significantly boost the launch of its experimental weight-loss pill, Orforglipron. Ricks added that the company expects Medicare coverage to begin immediately after the drug’s launch.

LLY Pulls Ahead As NOVO Faces Headwinds

Eli Lilly’s optimistic outlook stands in stark contrast to Novo Nordisk (NVO), which expects adjusted sales to decline between 5% and 13% and operating profit to drop by up to 13%. The company cited pricing pressure, intensifying competition, and upcoming patent expiries for the key ingredients in Wegovy and Ozempic in select markets outside the U.S.

“This is just more evidence they are dominating the category,” Mizuho’s Jared Holz told Bloomberg of Eli Lilly’s obesity market position. “Novo is playing from behind and everyone knows it.”

How Did Stocktwits Users React?

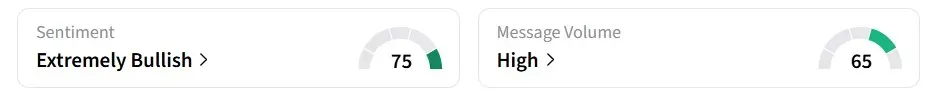

Retail sentiment on Stocktwits turned ‘bullish’ from ‘bearish’ over the past 24 hours, amid ‘high’ message volumes.

One user said that Lilly proved that with “a good product comes great demand.”

LLY shares have gained around 25% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)