Advertisement|Remove ads.

Eli Lilly Raises Full-Year Guidance By Whopping $3 Billion, Draws Retail Cheer

Shares of pharma giant Eli Lilly & Co (LLY) jumped over 13% on Thursday after the company surpassed Wall Street’s second-quarter estimates and raised its full-year guidance.

The firm reported earnings per share (EPS) of $3.92 compared to an estimate of $2.60 while revenue came in at $11.30 billion versus an estimate of $9.92 billion.

However, the highlight of the earnings report came in the form of an increase in its full-year guidance by $3 billion to the range of $45.40 billion to $46.60 billion. Management’s upgraded outlook was primarily driven by the strong performance of Mounjaro and Zepbound, as well as the firm’s non-incretin medicines.

Eli Lilly also increased its EPS guidance to the range of $15.10 to $15.60 on a reported basis compared to a previous guidance of $13.05 to $13.55. Non-GAAP EPS is expected to come in at $16.10-16.60 compared to prior guidance of $13.50-14.00.

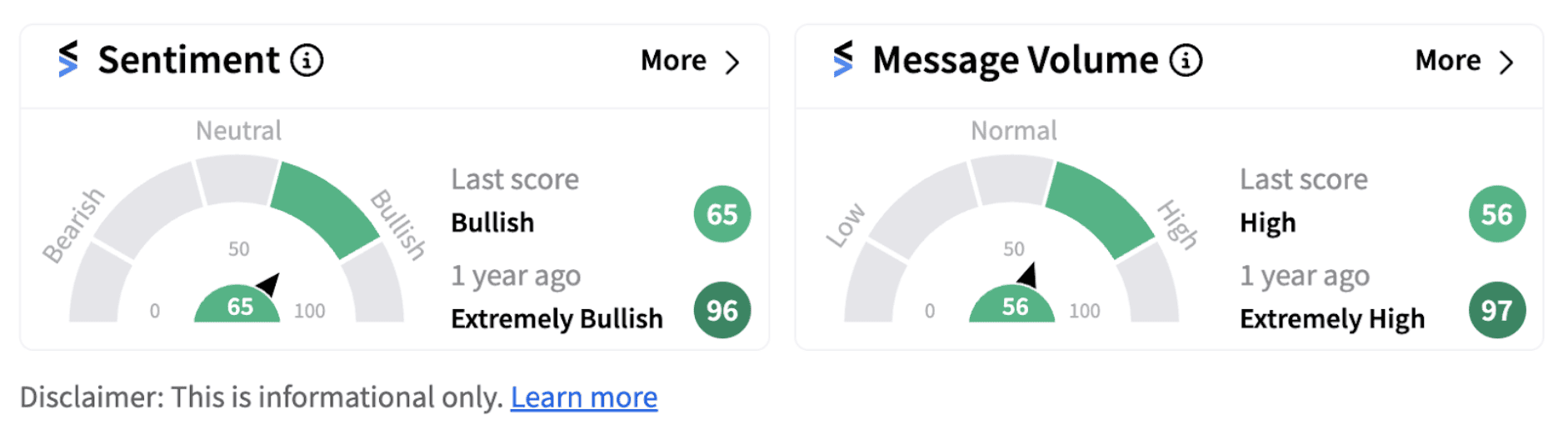

Following the upbeat announcement, retail sentiment on Eli Lilly continued to trend in the ‘bullish’ territory (65/100) amid ‘high’ message volumes.

David A. Ricks, Lilly's chair and CEO said Mounjaro, Zepbound and Verzenio led the firm’s strong financial performance during the quarter. "We also recently received approval of Kisunla to help people with Alzheimer's disease, a moment that was decades in the making,” he said.

During the second quarter, worldwide Mounjaro revenue stood at $3.09 billion versus $979.70 million in Q2 2023. Mounjaro is an injectable medicine for type-2 diabetes in adults. Zepbound, which launched in the U.S. for the treatment of adult patients with obesity or overweight with weight-related co-morbidities, saw U.S. revenue come in at $1.24 billion.

The firm’s pipeline progress included approval of Kisunla in the U.S. for Alzheimer's disease and Jaypirca in Japan for relapsed or refractory mantle cell lymphoma.

Some Stocktwits users, including "HighBetaAlgorithms" are bullish on the stock given that obesity has been a widespread problem in the U.S. and a growing concern globally.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dc9a399d51.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sable_offshore_jpg_81d3c0b91f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_136755254_jpg_032592fefb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245785968_jpg_f3b4cb1b18.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)