Advertisement|Remove ads.

Emerson Electric Stock Soars After Upbeat Q4, Proposal To Fully Acquire AspenTech: Retail Cheers The Deal

Shares of engineering services provider Emerson Electric Co ($EMR) jumped nearly 8% on Tuesday after the firm reported an upbeat fourth-quarter earnings and proposed to acquire the remaining outstanding shares of AspenTech for $240 apiece in cash.

Revenue rose 13% year-over-year (YoY) to $4.62 billion, beating a Wall Street estimate of $4.57 billion. Earnings per share came in at $1.48 versus an estimate of $1.47.

The company declared a quarterly cash dividend increase to $0.5275 per share of common stock payable Dec. 10, 2024 to stockholders of record Nov. 15, 2024.

CEO Lal Karsanbhai said the firm has made significant progress on its value-creation roadmap over the past three years, and the strategic actions announced on Tuesday mark the final phase of its portfolio transformation.

On Tuesday, the company made a proposal to acquire all outstanding shares of common stock of AspenTech ($AZPN) not already owned by Emerson for $240 per share in cash.

The proposal implies a fully diluted market capitalization for AspenTech of $15.3 billion and an enterprise value of $15.1 billion.

Emerson currently owns approximately 57% of AspenTech’s outstanding shares of common stock and on completion of the transaction, AspenTech would become a wholly owned subsidiary of the firm.

The company, meanwhile, has commenced a process to explore strategic alternatives, including a cash sale, for the Safety & Productivity segment. This comprises the remaining businesses not related to automation in Emerson’s portfolio.

The proposed price represents a multiple of 29x consensus estimates for AspenTech’s fiscal year 2025 adjusted earnings before interest, tax, depreciation, and amortization (EBITDA).

The proposal has been delivered in a letter to AspenTech’s Board of Directors and has been filed with the SEC, the company said.

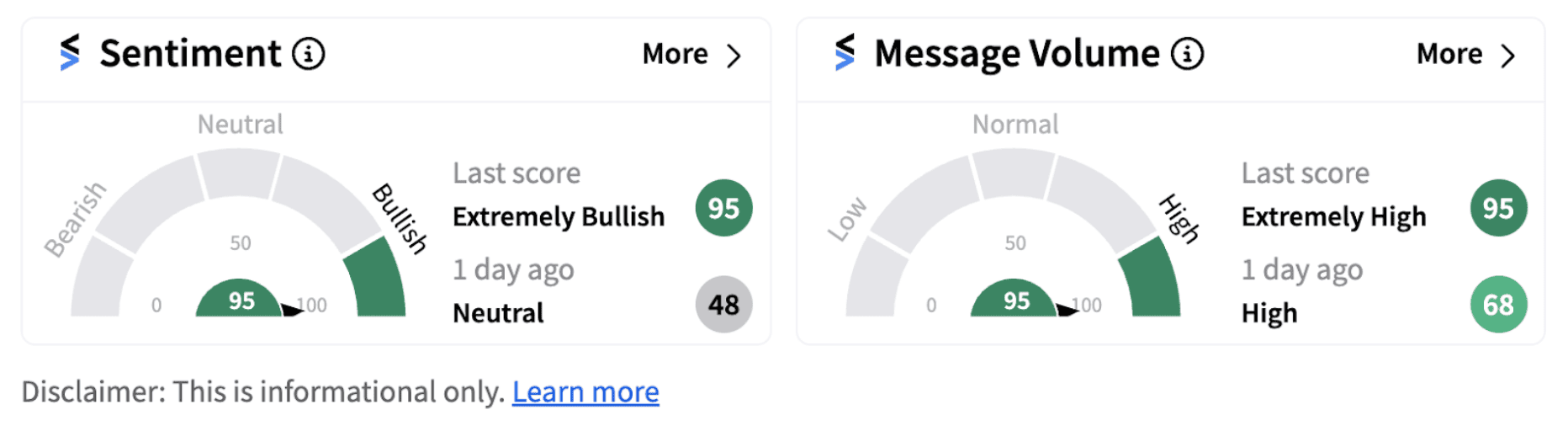

Following the announcement, retail sentiment on Stocktwits jumped into the ‘extremely bullish’ territory (95/100), accompanied by ‘extremely high’ message volume.

Shares of Emerson Electric have gained over 22% on a year-to-date basis.

Also See: KFC Parent Yum! Brands' Stock Rises Despite Q3 Miss: Retail Hungry For More

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)