Advertisement|Remove ads.

Enersys Stock Falls After-Hours On Tepid Q1 Forecast, Retail’s Upbeat Following Strong Finish To Fiscal 2025

Enersys (ENS) stock slipped 1.6% in extended trading on Wednesday after the company’s fiscal first-quarter earnings forecast was below Wall Street’s estimates.

The battery solutions firm forecasted quarterly earnings between $2.03 and $2.13 for the first quarter of fiscal year 2026, while analysts expect it to post $2.40 per share, according to FinChat data.

Enersys also projected its net sales in the range of $830 million to $870 million, below Wall Street’s estimated $906.9 million.

"Our fiscal first quarter 2026 guidance reflects typical seasonal volume softness in Motive Power and Transportation, exacerbated by short-term macro dynamics. We also expect to absorb some short-term headwinds from stranded tariffs in the quarter," Chief Financial Officer Andrea Funk said.

The dour earnings overshadowed a stronger fourth-quarter earnings report, as the company topped both earnings and revenue estimates.

Enersys reported adjusted earnings of $2.97 per share, while analysts were expecting it to report $2.78 per share.

The company said its Energy Systems segment saw growth in data center and continued signs of recovery in U.S. communications. Its specialty segment benefited from sustained strength in the aerospace and defense market.

“We are proactively adjusting pricing, costs, working capital, supply chain, and manufacturing to protect both volumes and profitability,” incoming CEO Shawn O’Connell said about the tariff impact.

Enersys also paused its fiscal 2026 outlook due to uncertainty around government regulations and demand normalization.

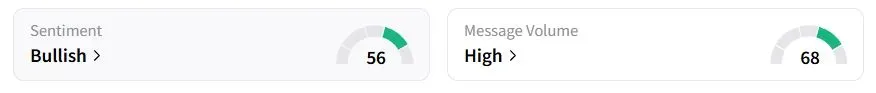

Retail sentiment on Stocktwits was in the ‘bullish’ territory, while retail chatter was ‘high.’

Enersys stock has gained 2.7% year to date (YTD).

Also See: CAE Stock Slips After RBC Capital Downgrade On Lack Of Catalysts: Retail’s Split

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)