Advertisement|Remove ads.

Enterprise Products Partners Tops Q4 Estimates, Retail’s Energized

Enterprise Products Partners (EPD) garnered retail attention on Tuesday after the company beat fourth-quarter revenue estimates.

The company posted fourth-quarter revenue of $14.20 billion, which topped Wall Street estimates of $14.13 billion, according to FinChat data.

Net income rose to $1.62 billion, or $0.74 per share, compared with $1.57 billion, or $0.72 per share in the year-ago quarter.

Enterprise Product’s fourth quarter total equivalent pipeline transportation volumes rose to 13.6 million barrels per day (bpd) on average from 12.7 million bpd last year.

In the fourth quarter, its natural gas processing plant inlet volumes grew 7% to 7.6 billion cubic feet/day.

Natural gas production at the largest U.S. shale oilfield had soared to record levels in 2024. However, a lack of pipeline capacity had pushed gas prices below zero in the area.

“This growth in volumes, earnings, and cash flow is directly related to the investments we have made in these businesses that continue to benefit from production growth in the Permian Basin as well as increases in domestic and international demand,” said AJ Teague, co-chief executive officer of Enterprise’s general partner.

The company said it currently has about $7.6 billion of significant projects under construction related to its natural gas and natural gas liquids (NGL) businesses serving the Permian Basin.

Enterprise and its peers are also betting on an upcoming rise in demand for natural gas for power generation and liquefied natural gas exports.

The company’s shares were down 0.4% in morning trade.

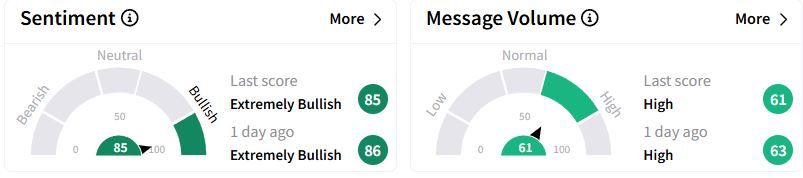

Retail sentiment on Stocktwits stayed at ‘extremely bullish’ (85/100) territory while retail chatter was high.

Stocktwits users were bullish on the stock, with one investor hoping analysts might upgrade its rating.

Over the past year, Enterprise stock has gained 25.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)