Advertisement|Remove ads.

SentinelOne Stock Snags Price Target Cut Ahead Of Q4 Results: Retail Mood Stays Downbeat

Shares of SentinelOne, Inc. (S) received a price target ahead of the artificial intelligence (AI)-powered cybersecurity company’s quarterly results due after the market closes Wednesday.

In his earnings preview note, JPMorgan analyst Brian Essex reduced the price target for SentinelOne stock to $27 from $33 and maintained an ‘Overweight’ rating. He attributed the price cut to a contraction in peer multiples, TheFly reported.

The analyst expects the Mountain View, California-based company to report net new annual recurring revenue (ARR) just over the consensus estimates.

ARR at the end of the third quarter was up 29% to $859.7 million.

Essex also looked forward to “constructive” guidance for the fiscal year 2026.

JPMorgan said its industry conversations were mixed to slightly positive for the quarter. This reinforced management's view that CrowdStrike Holdings, Inc. (CRWD) outage-related benefit is materializing in the company’s pipeline, it added.

On average, analysts expect SentinelOne to report adjusted earnings per share (EPS) of $0.01 and revenue of $222.33 million, compared to a loss of $0.02 per share and revenue of $174.2 million, respectively, for the year-ago quarter.

The company’s guidance issued in early December called for revenue of $222 million, an adjusted gross margin of 79%, and an adjusted operating margin of a negative 3%.

Among peers, Palo Alto Networks, Inc. (PANW) reported a double beat for the quarter ended Jan. 2025, but the guidance was lackluster. Crowdstrike announced a Q4 beat but experienced a slowdown in revenue growth and key operational metrics. The company also issued mixed forward guidance.

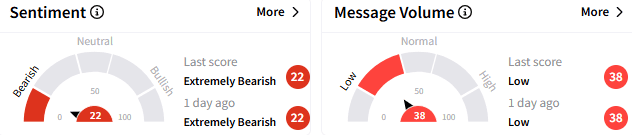

On Stocktwits, sentiment toward SentinelOne stock was ‘extremely bearish’ (22/100), and the message volume remained ‘low.’

SentinelOne stock ended Friday’s session down 0.30% at $19.84. The stock is down over 10% year-to-date.

Morgan Stanley reduced the price target for the stock in mid-February, citing its channel checks that suggested a lack of inflection in competitive win rates. The firm said the setup remained challenging.

For updates and corrections email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)