Advertisement|Remove ads.

AppLovin Stock Under Pressure As It Misses Out On S&P 500 Inclusion — Retail Braces For More Weakness

Shares of AppLovin Corp. (APP) came under selling pressure in Friday’s after-hours session after it was overlooked for S&P 500 Index inclusion as part of the index’s quarterly rebalance.

S&P Dow Jones customarily rebalances its flagship market-capitalizes index series every quarter so that constituent companies continue to meet the inclusion criteria.

Rebalancing usually impacts volume, stock prices, and, at times, even broader market sentiment as fund managers make changes to the index-tracking mutual funds and exchange-traded funds (ETFs) to mirror the changed weighting of the indices.

Late Friday, S&P Dow Jones Indices said DoorDash, Inc. (DASH), KO Group Holdings Inc. (TKO), Williams-Sonoma Inc. (WSM) and Expand Energy Corp. (EXE) will join the S&P 500 Index, effective prior to the market open on March 24.

These companies will replace Borgwarner Inc. (BWA), Teleflex Inc. (TFX), Celanese Corp. (CE) and FMC Corp. (FMC) in the S&P 500, respectively, in the broader index.

AppLovin investors were positioning for a nod from S&P Dow Jones Indices ahead of the announcement.

AppLovin shares climbed over 712% in 2024, and gained further ground following its fourth-quarter results released on Feb. 13. After the post-earnings high of $525.15, the stock consolidated the gains.

A report from short-seller Edwin Dorsey on Feb. 20 dragged the stock lower and the weakness has lingered amid the broader market pullback seen since.

For the year-to-date period, the stock is down about 16.50%.

The volatility seen in AppLovin shares may have served as a deterrent, keeping the index compiler on the sidelines.

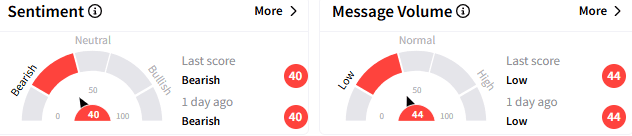

On Stocktwits, retail sentiment toward AppLovin stock remained ‘bearish’ (40/100) and the message volume stayed at ‘normal’ levels.

A bearish watcher said the S&P 500 snub is another reason for not being bullish on the stock.

https://stocktwits.com/Fearlesstrader108/message/607250709

Another user expected at least a 20% drop on Monday.

https://stocktwits.com/MSCFcpas/message/607293269

However, the sell side is optimistic. The TipRanks-compiled average analysts’ price target for the stock is $530.81, suggesting nearly 100% upside potential.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243817419_jpg_fd782b2997.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191224409_jpg_fd3e69e2d7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229305833_jpg_f9b80a181a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tom_Lee_9782f9c21f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_AES_July_a52bf06b47.webp)