Advertisement|Remove ads.

EOS Energy Slips After-Hours Following 32% Jump On Record Quarterly Revenue: Retail’s Extremely Bullish

EOS Energy (EOSE) stock fell 6.2% in extended trading on Wednesday after making its biggest single-day jump in over four months.

The company filed a shelf registration statement for the sale of 158.4 million shares of its common stock to a lender as part of a previous agreement the company struck to raise cash.

The stock jumped 32.3% on Wednesday after posting its highest quarterly revenue on record, fueled by higher production.

According to LSEG data, the energy solutions company reported first-quarter revenue of $10.5 million for the three months ended March 31, which topped estimates of $10.4 million.

It reported an adjusted net loss of $0.17 per share, while analysts expected it to post a loss of $0.21 per share.

The company said it had a $680.9 million order backlog as of March 31.

In the first quarter, Eos grew its opportunity pipeline to $15.6 billion, an increase of $1.4 billion from the prior quarter. This was driven by big opportunities in Puerto Rico, multiple eight-hour potential projects in California, and new direct and indirect data center projects.

EOS said its 2025 year-to-date shipments have already surpassed the total shipments for all of 2024.

The company also reiterated its full-year revenue forecast between $150 million and $190 million.

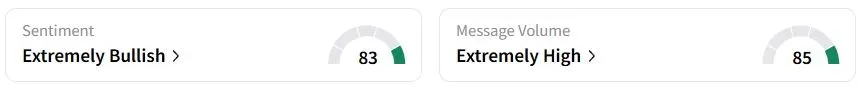

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (83/100) territory, while retail chatter was ‘extremely high.’

However, some users raised alarms over further dilution of the stock.

EOS Energy stock has gained nearly 34% year to date (YTD).

Also See: Occidental Petroleum Stock In Spotlight After Q1 Profit Beat: Retail Sits On The Fence

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2147920616_jpg_ab875c9370.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cybercab_resized_jpg_1588e769f9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_zim_shipping_jpg_42b726c79d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)