Advertisement|Remove ads.

Estee Lauder Gets A Price Target Hike From Canaccord Ahead of Earnings: Find Out More

Estee Lauder (EL) received a price target hike from Canaccord ahead of its earnings on Wednesday, with the firm expecting a profit recovery for fiscal 2027 as the cosmetics giant’s turnaround plan takes hold under new CEO Stephane de La Faverie.

The company is expected to post fourth-quarter revenue of $3.40 billion, which would imply a 10.7% decline year-over-year and earnings per share (EPS) of $0.09, according to data compiled by Stocktwits.

Canaccord raised its price target on Estee Lauder to $85 from $62 and maintained a ‘Hold’ rating on the shares, according to TheFly. However, the firm said that Estee Lauder’s earnings remain depressed with little visibility around a more structural recovery.

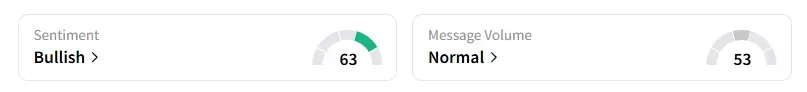

Retail sentiment on Estee Lauder remained unchanged in the ‘bullish’ territory, with message volumes at ‘normal’ levels, according to data from Stocktwits. Shares of the company were marginally up during midday trading.

On the tariff front, Telsey Advisory Group said in a note last week that Estee Lauder was actively reducing its reliance on China by shifting production to Japan and Europe, a strategy that is also being mirrored in the Europe, Middle East, and Africa region.

Last week, “Big Short” investor Michael Burry of Scion Asset Management reduced his stake in the beauty and cosmetics maker by 25%. Burry had doubled his stake to 200,000 shares in Estee Lauder in May, which is undergoing the reset under de La Faverie. The new CEO has been working to grow demand for the company’s products after several quarters of slowdown in North America and China, two of its major markets.

Estee Lauder stock has gained nearly 22% so far this year and lost about 2% of its value in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219301415_jpg_7634ca599c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2236469013_jpg_0a72164947.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)