Advertisement|Remove ads.

Eternal’s Stock Hits Record High As Goldman Sachs Raises Price Target

Heavy buying interest in the last hour of trade on Thursday pushed Eternal’s stock to a fresh all-time high. It was the top Nifty gainer at close.

Eternal’s shares closed 2.9% higher at ₹337.85, marking a fourth consecutive session of gains. The stock added 5.1% over the period.

Why Did The Stock Surge?

Eternal’s stock picked up late momentum after global brokerage firm Goldman Sachs raised its target price to ₹360 per share from ₹340 earlier.

The brokerage highlighted strong momentum in Eternal’s quick commerce arm, Blinkit. Margins for Blinkit are expected to expand by 240 basis points over the next two quarters, with EBITDA breakeven projected by December 2025.

Goldman Sachs added that the quick commerce business could act as a key growth driver for Eternal’s stock, though its full potential is yet to be priced in.

Stock Watch

According to NSE data, the market capitalization of Eternal, the parent company of food delivery business Zomato and quick commerce firm Blinkit, is ₹3.26 trillion. This is almost three times the value of its rival Swiggy, whose market cap as of Thursday’s close is ₹1.10 trillion.

Swiggy’s stock closed 0.84% at ₹444.65.

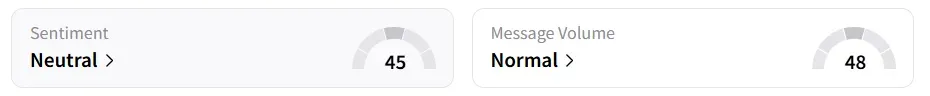

While retail sentiment for Eternal shifted to ‘neutral’ from ‘bullish’ last week, the stock still gained 4.1% during the period. It was among the top trending stocks on Stocktwits.

Year-to-date, Eternal’s share value has increased by 21.6%.

On the contrary, Swiggy has been under some selling pressure so far this year, shedding over 18%.

Retail sentiment for Swiggy remains ‘bearish’. It was ‘neutral’ a week ago. The sentiment over a one-year period has largely been ‘neutral’.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)