Advertisement|Remove ads.

Etsy Beats Q1 Revenue Estimates, Unveils Tariff Mitigation Plan: Retail Turns Very Optimistic

Etsy (ETSY) reported mixed quarterly results on Wednesday, and its shares fell nearly 6% in a broad market selloff after new data showed contraction in the U.S. economy.

Revenue rose 1% to $651.2 million in the first quarter, solidly beating estimates of $643 million from LSEG/Reuters. However, the adjusted profit of $0.46 per share was below the expectation of $0.49.

Etsy said it booked an impairment charge of $101.7 million related to the sale of Reverb, leading to a net loss of $52.1 million in the quarter compared to a $68 million profit last year.

Last month, Etsy announced plans to divest the musical instrument marketplace it acquired in 2019, citing a renewed focus on its core platform and Depop, the secondhand fashion app it purchased in 2021.

Etsy is an online marketplace focused on handcrafted goods. It has previously stated that, compared to other retailers, it relies less on products sourced from China.

CFO Lanny Baker said the company is “staying nimble in the face of uncertainty” around the tariff announcements and “the fluid state of consumer confidence in our core markets.”

The company said it has started prominently promoting locally made products on its platform and has formed a task force to manage tariff-related challenges.

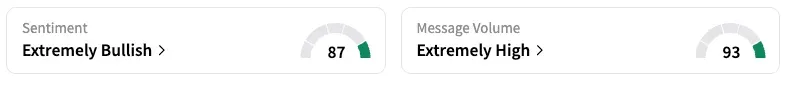

On Stocktwits, sentiment turned to 'extremely bullish' from 'bearish' a day prior, and message volume jumped to 'extremely high'.

Etsy stock is down 17.8% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_tesla_cybertruck_resized_7ce9ec6562.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_stock_jpg_770e12377f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206312585_jpg_1a7c050dff.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205716060_jpg_b54d4e2d13.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)