Advertisement|Remove ads.

Trump Blames His Predecessor After Q1 GDP Contracts: ‘Our Country Will Boom, But We Have To Get Rid Of The Biden Overhang’

President Donald Trump blamed the Biden administration after the first-quarter GDP contracted while defending his tariff policies, saying that companies are starting to relocate to the U.S. in record numbers.

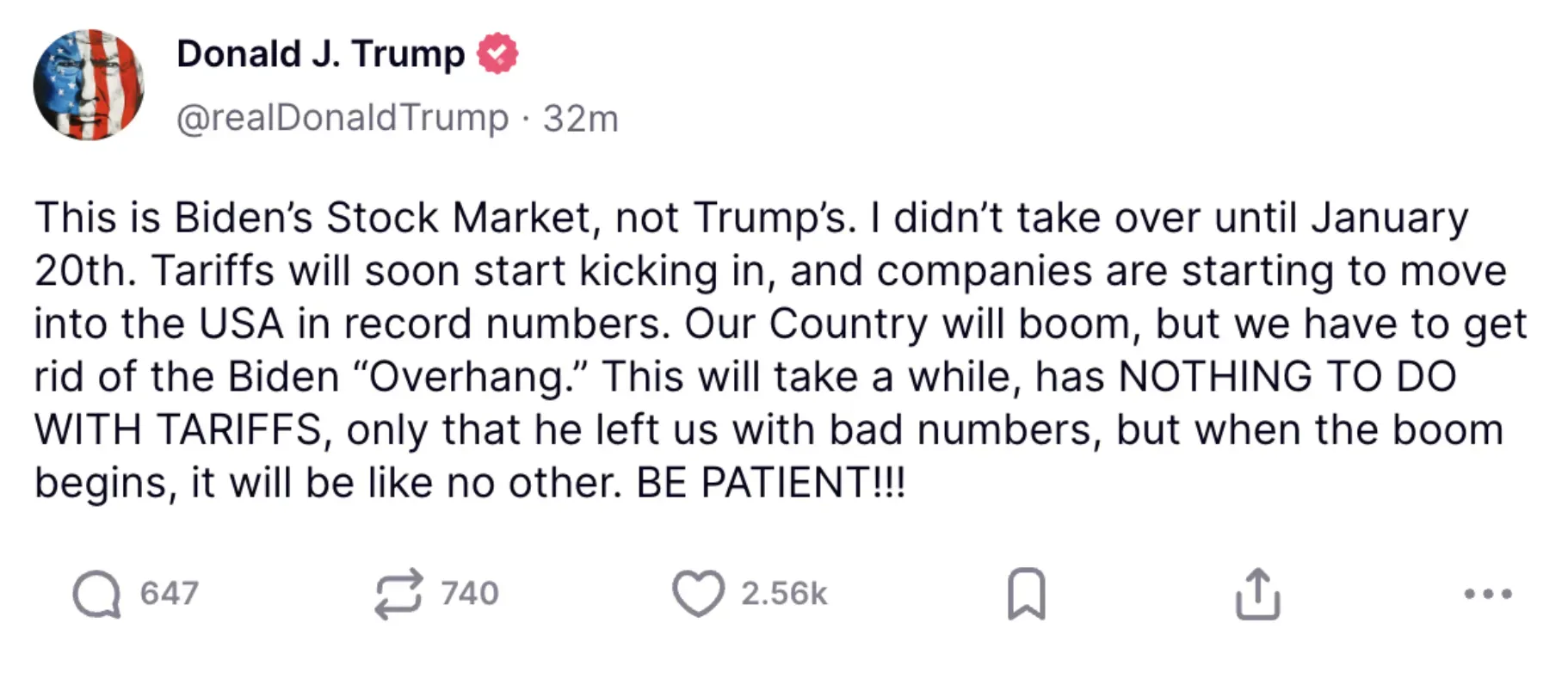

“This is Biden’s Stock Market, not Trump’s. I didn’t take over until January 20th,” he wrote on his Truth Social account.

Trump stated that tariffs will soon begin to take effect and noted that companies are starting to relocate to the U.S. in record numbers.

“Our Country will boom, but we have to get rid of the Biden “Overhang.” This will take a while, has NOTHING TO DO WITH TARIFFS, only that he left us with bad numbers, but when the boom begins, it will be like no other. BE PATIENT!!!” he added.

Trump’s statement follows a contraction in the first-quarter (Q1) GDP at an annual rate of 0.3%. According to a CNBC report, this was the first quarter of negative growth since the first quarter of 2022.

The report noted that economists surveyed by Dow Jones anticipated a 0.4% gain after the GDP rose by 2.4% in the fourth quarter of 2024.

The Bureau of Economic Analysis stated that the decrease in Q1 real GDP primarily reflected an increase in imports and a reduction in government spending. This was partly offset by increases in investment, consumer spending, and exports.

Meanwhile, private payrolls increased by just 62,000 in April, below the Dow Jones consensus estimate of 120,000, according to CNBC.

Following the disappointing GDP number, the S&P 500 and the Nasdaq Composite fell 2%, while the Dow Jones declined by 700 points, spooked by fears of a recession.

The SPDR S&P 500 ETF Trust (SPY), which tracks the S&P 500, traded 2.26% lower on Wednesday morning, while the Invesco QQQ Trust, Series 1 (QQQ), which tracks the Nasdaq Composite, traded 2.62% lower.

Also See: Etsy Stock Rises On Upbeat Q1 Revenue, Company Says It’s Staying Nimble In The Wake Of Tariff-Led Uncertainties

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)