Advertisement|Remove ads.

Etsy Retail Trader Confidence Improves After Boost From ChatGPT Tie-Up: All Eyes On Q3 Print Next

Etsy, Inc. stock, high on investors’ radar after the company’s partnership with ChatGPT operator OpenAI, was among the top trending tickers on Stocktwits late Sunday as retail traders discussed their positions.

Shares of the specialty online retailer gained 2.5% last week, which many see as a sign of its defensiveness and setup for further gains.

“Etsy $ETSY pulled back last week, but it stayed above the previous weekly MA (now ex) resistance band it recently smashed through,” said a Stocktwits user.

“The break, therefore, still holds strong,” they added, referring to the nearly 16% gain on Sept. 29 after the unveiling of a partnership enabling consumers to shop Etsy products on ChatGPT.

Another user said that Etsy trading charts show volatility contraction pattern (VCP) and base-on-base patterns, which, coupled with catalysts such as Etsy’s listing transferring to the New York Stock Exchange last week, signal “huge breakout potential.”

Shares of Etsy, a marketplace for handmade, vintage, and unique craft goods, including jewelry, home decor, and clothing, are having a strong run. They are up about 38% from a recent low on Sept. 2 and 33.2% year-to-date.

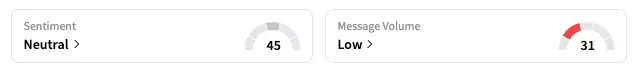

On Stocktwits, the retail sentiment for the stock shifted to ‘neutral’ as of late Sunday, from ‘bearish’ in mid-week. Currently, 20 of the 31 brokerages covering the ETSY recommend ‘Hold,’ nine rate it ‘Buy’ or higher, and two rate it ‘Sell,’ according to Koyfin data. Their average price target of $66.65 is about $4 lower than the stock’s last close.

Etsy will report third-quarter results on Oct. 29, with analysts expecting revenue to drop nearly 1% to $656.6 million and about a 9% growth in adjusted EPS to $1.03, per Koyfin.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)