Advertisement|Remove ads.

Alphabet, Snap Stocks In Focus As European Commission Wants To Dig Into YouTube, Snapchat Algorithms: Retail Unfazed For Now

The European Commission has requested information from Alphabet Inc’s (GOOG) YouTube, Snapchat (SNAP), and TikTok under the Digital Services Act (DSA) to provide more information on the design and functioning of their recommender systems.

The Commission has asked YouTube and Snapchat to provide detailed information on the parameters used by their algorithms to recommend content to users and their role in amplifying certain systemic risks.

The parameters include those related to the electoral process and civic discourse, users' mental well-being (e.g. addictive behavior and content ‘rabbit holes'), and the protection of minors, it said in a statement.

The Commission noted that the questions also concern the steps taken by the platforms' to counter the potential influence of their recommender systems on the spread of illegal content, like the promotion of illegal drugs and hate speech.

Meanwhile, TikTok has been requested to submit more information on the measures taken to avoid the manipulation of the service by malicious actors and to mitigate risks related to elections, pluralism of media, and civic discourse.

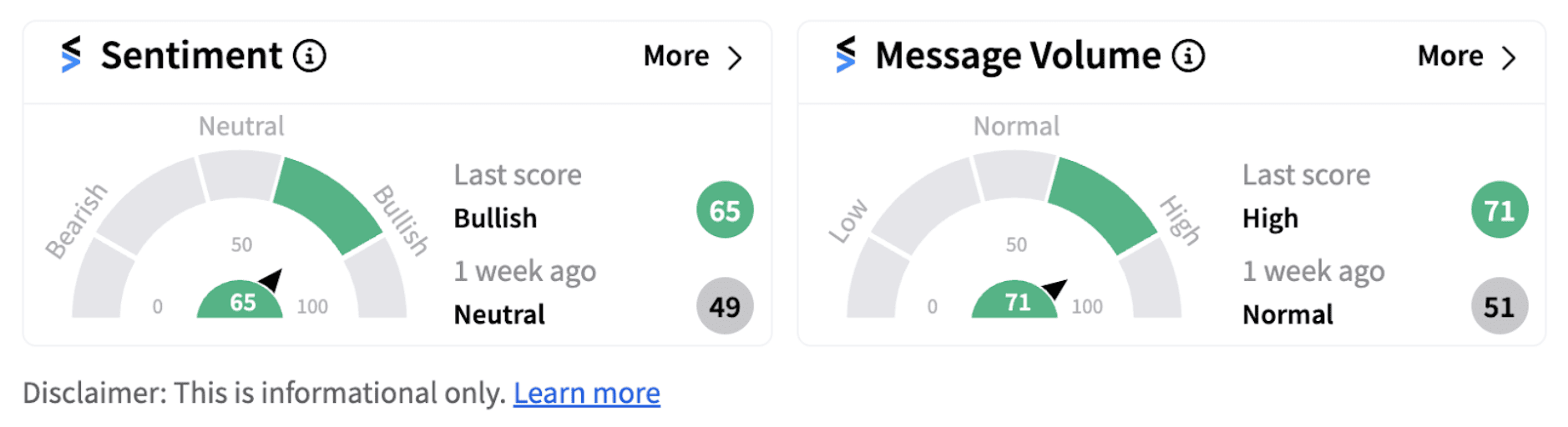

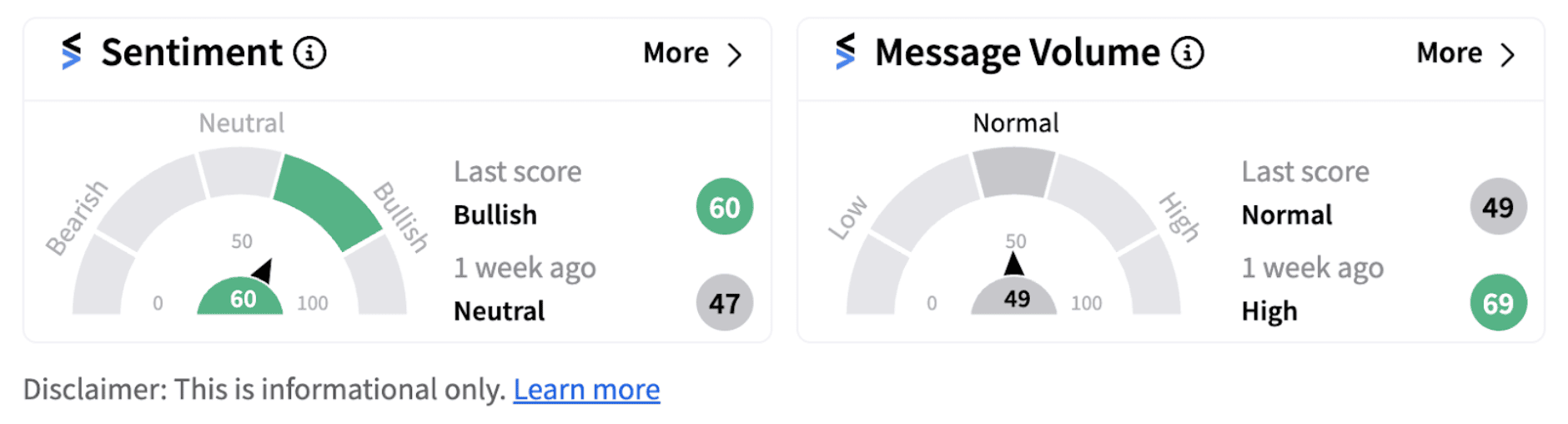

Retail investors on Stocktwits, however, are not concerned about the development with the sentiment meter for both stocks remaining firmly in the ‘bullish’ territory.

Despite the bullish takes by retail investors, both stocks have shown significant divergence in their year-to-date returns so far. While Alphabet Inc has managed to record over 20% returns, Snap Inc shares have lost more than 35% during the period.

Recently, Snap CEO Evan Spiegel wrote in a letter to employees that the company is pacing towards record annual revenue with the firm further accelerating the growth of its advertising business and diversifying its revenue with Snapchat+.

However, last month, the firm was in the news for different reasons. The State of New Mexico filed a lawsuit against Snap Inc (SNAP) alleging that the firm and its social media service Snapchat are “among the most pernicious purveyors of child sexual abuse material and harm-inducing features on children’s electronic devices.”

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)