Advertisement|Remove ads.

Expedia Retail Traders Remain Optimistic Despite Q1 Revenue Miss Ahead Of Holiday Travel Season

Expedia Group (EXPE) on Friday reported quarterly revenue below Wall Street estimates, citing weak travel activity in the U.S., sending its shares down 7.3%.

The firm's report echoes the sentiment across the travel and hospitality sector, where demand is strained due to macroeconomic uncertainties and geopolitical unrest.

Hilton (HLT) and Marriott (MAR) recently cut their room revenue forecasts for this year, while Airbnb (ABNB) has said that the booking window has shortened.

For the first quarter, Expedia reported revenue of $2.98 billion, below analysts' expectations of $3.01 billion from LSEG/Reuters.

Adjusted profit was $0.40 per share, above expectations of $0.32.

CEO Ariane Gorin blamed the "weaker than expected demand in the U.S." for the topline miss.

The perspective has also worried investors as it sets a weak tone for the summer holiday season, where travel companies expect significant business.

Approximately two-thirds of Expedia's business comes from the U.S., where consumers are most affected by the uncertainty caused by President Donald Trump's dynamic policy environment.

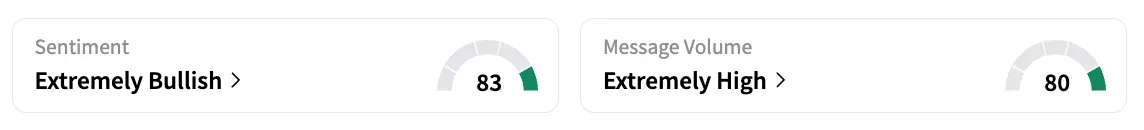

However, on Stocktwits, retail sentiment held in the 'extremely bullish' territory, unchanged from the previous week.

Expedia stock is down 16% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)